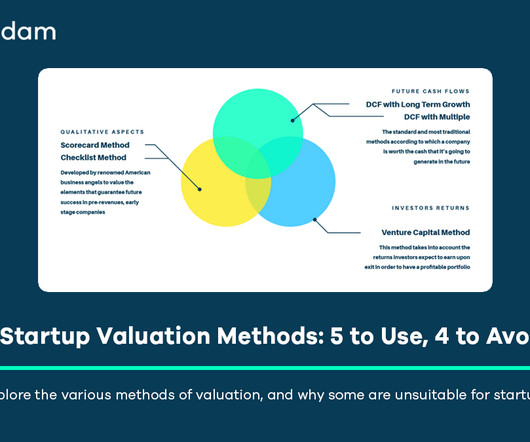

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Instead of comparing to an average, it typically starts with a maximum potential pre-money valuation deemed achievable for a startup of that type in its region. Unlike the Scorecard, it doesn’t explicitly benchmark against competitors but focuses on the startup’s internal milestones and risk mitigation.

Let's personalize your content