ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

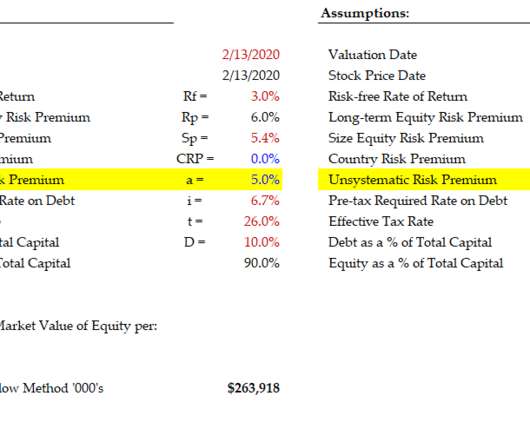

This work can be used to reconcile and support an adjustment to the CAPM, then the WACC, via Alpha and Beta. They combine elements of the Income Method, which is cash flow based, and the Market Method, which is based on comparative analysis. Adjustments to Beta can accomplish this. What about stock price?

Let's personalize your content