Down Round Valuation: How to Survive and Protect Your Equity (2025)

Equidam

JUNE 30, 2025

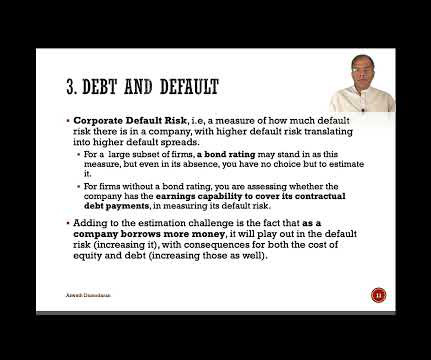

Updated Market Conditions Inputs – Risk-free rates: Now 4-5% vs. near-zero during ZIRP – Market risk premiums: Adjusted for current volatility and country-specific factors – Survival rates: Updated data reflecting current market conditions 2. Here’s how Equidam approaches this: 1.

Let's personalize your content