Country Risk: A 2022 Mid-year Update!

Musings on Markets

JULY 13, 2022

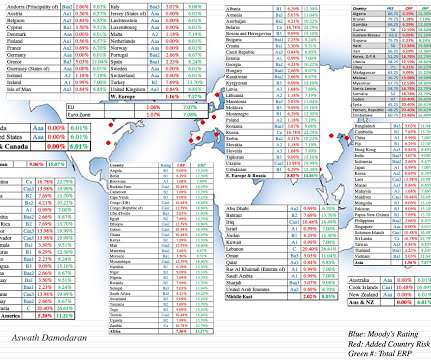

Country Risk: Default Risk and Ratings For investors, the most direct measures of country risk come from measures of their capacity to default on their borrowings. Country Risk: Equity Risk For equity investors, the price of risk is captured by the equity risk premium, and equity risk premiums will vary across countries.

Let's personalize your content