How to Get a BSPCE Valuation for Your Startup’s Employee Share Plan

Equidam

JUNE 10, 2025

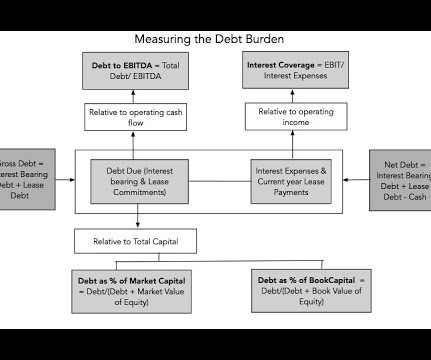

Beneficiaries of BSPCEs are typically employees and executive managers of the company (and since 2019, also employees of its subsidiaries), as well as certain board members – essentially the people actively involved in building the company. It’s a fundamental valuation approach grounded in the company’s expected future performance.

Let's personalize your content