Selling Your Business? Are Your Earnings “Quality Earnings”?

RC & Co.

FEBRUARY 6, 2022

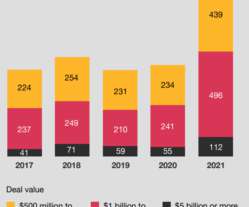

Minority stakes and private equity acquisitions followed next with 309 and 185 deals during the quarter, respectively. A robust M&A market to say the least! We suggest that the same basic concept applies to your business when you place it on the market for sale. Make sure you know the answer.

Let's personalize your content