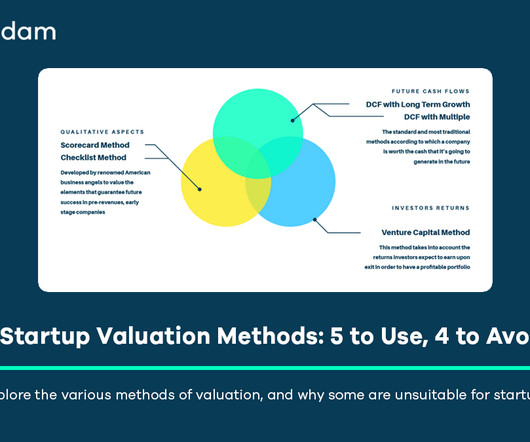

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Furthermore, any quantitative valuation method, particularly the Discounted Cash Flow (DCF) approach, is highly sensitive to the underlying assumptions about growth rates, discount rates, and terminal values. The terminal value is estimated by applying a market-based multiple to a financial metric of the final projected year.

Let's personalize your content