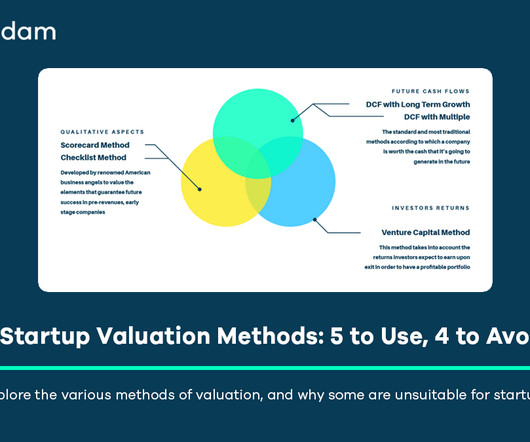

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

revenue multiple, ARR multiple, EBITDA multiple) derived from recent acquisitions or funding rounds of supposedly similar companies. Instead of comparing to an average, it typically starts with a maximum potential pre-money valuation deemed achievable for a startup of that type in its region.

Let's personalize your content