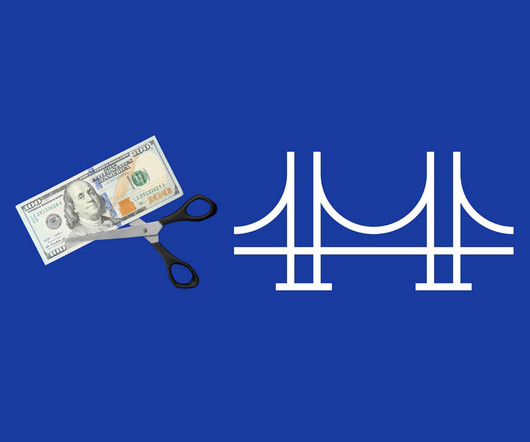

Net Debt Bridge – Concept and Formula Explained

Valutico

MARCH 12, 2024

Enterprise Value (EV) is the total value of a company, considering both its debt and equity. Equity Value (EQV) represents the value attributable to the company’s shareholders. EV considers both debt and equity, whereas EQV focuses solely on the value attributable to shareholders.

Let's personalize your content