ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

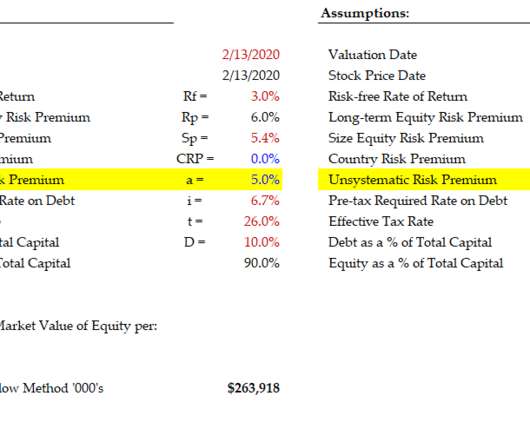

Alpha is an adjustment made to the Capital Asset Pricing Model (“CAPM”) as part of the calculation of the Weighted Average Cost of Capital, or “WACC.” It is an income approach, using discounted cash-flow analysis. Using Alpha, however, it could be done. Sources: [1] [link]. [2]

Let's personalize your content