How to Get a BSPCE Valuation for Your Startup’s Employee Share Plan

Equidam

JUNE 10, 2025

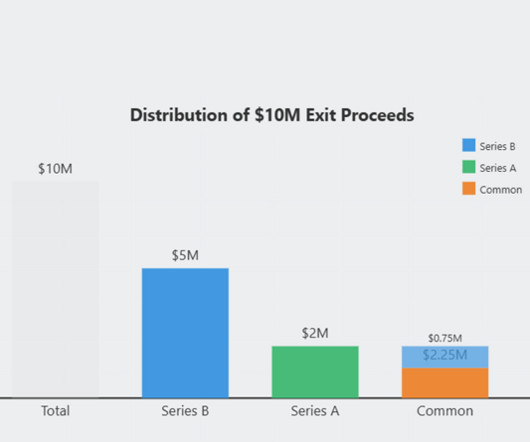

We’ll also cover the legal requirements (fair market value, documentation, audit readiness) and show why an accurate, compliant valuation is crucial to maintain the tax benefits. They may pay a small exercise price in the future to buy the shares (often set at the current fair market value).

Let's personalize your content