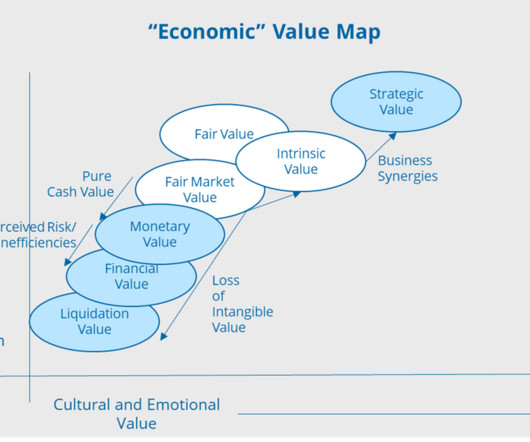

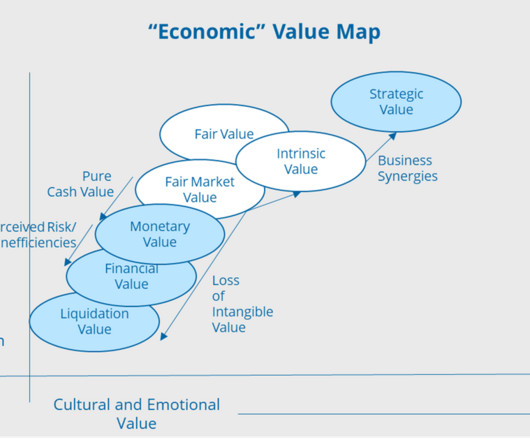

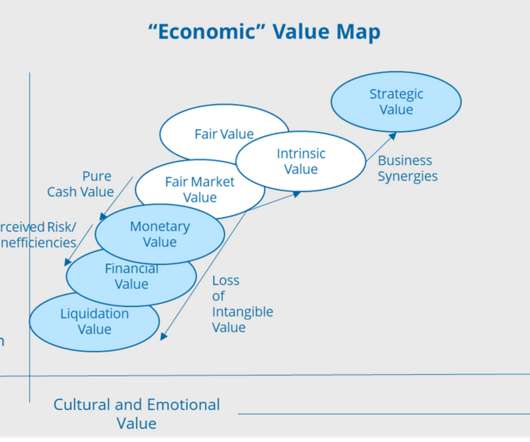

Transcending Value – Liquidation, Monetary, Financial, and Strategic Value

Value Scope

JUNE 2, 2021

Environmental, social, and governance (ESG) value is relatively new, and gaining acceptance in corporate America. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

Let's personalize your content