ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

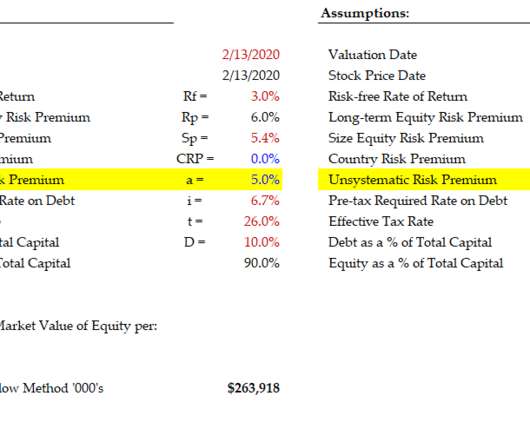

This work can be used to reconcile and support an adjustment to the CAPM, then the WACC, via Alpha and Beta. We know ESG is important and valuable, but it will be even more valuable when it is clearly quantified and valued using conventional and customary approaches. Do ESG programs impact firm value?

Let's personalize your content