ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

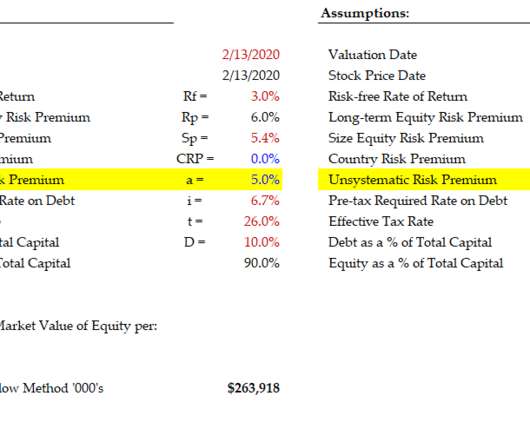

This work can be used to reconcile and support an adjustment to the CAPM, then the WACC, via Alpha and Beta. Adjustments to Beta can accomplish this. Beta measures systemic risk, and the performance of a company as compared with a broad index like the S&P 500 or the Russell 2000. Using Alpha, however, it could be done.

Let's personalize your content