The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

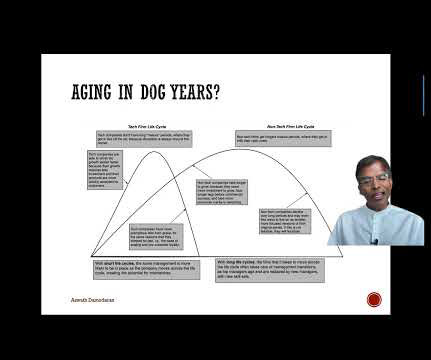

If your strength as an analyst or appraiser is in bounded story telling , you will be better served valuing young companies, whereas if you are a number-cruncher (comfortable with accounting ratios and elaborate spreadsheet models), you will find valuing mature companies to be your natural habitat.

Let's personalize your content