Valutico Unveils 6 Powerful New Features

Valutico

MAY 28, 2025

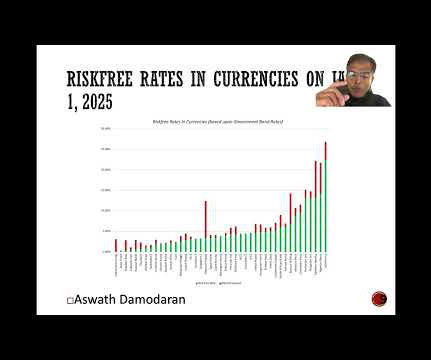

Valutico | June 3 2025 Were thrilled to begin rolling out a suite of powerful new features designed to take your valuation process to the next level. Weve enhanced the standalone Cost of Capital step with updated chartsnow including visuals for the Cost of Equity premium, Spread over Risk-Free Rate, and Debt/Equity ratio, among others.

Let's personalize your content