Corporate Racial Equity Tracker

Harvard Corporate Governance

JUNE 20, 2022

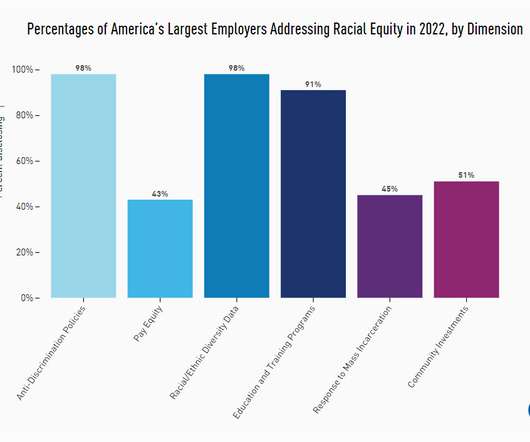

Posted by Kavya Vaghul and Ashley Marchand Orme, JUST Capital, on Monday, June 20, 2022 Editor's Note: Kavya Vaghul is Senior Director of Research and Ashley Marchand Orme is Director of Corporate Equity at JUST Capital. employers, through 23 metrics across six specific dimensions of racial equity: Anti-Discrimination Policies.

Let's personalize your content