What Is Risk-Free Rate?

Andrew Stolz

AUGUST 4, 2020

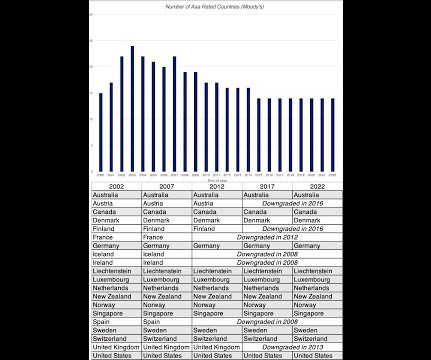

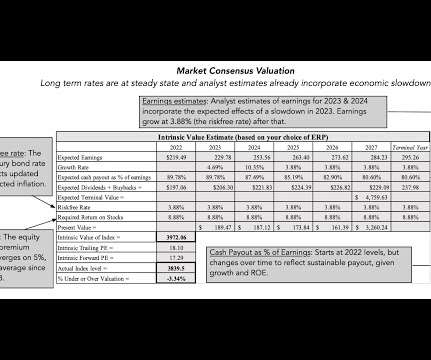

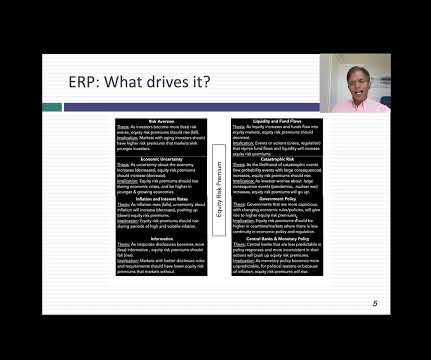

Definition of Risk-Free Rate. The risk-free rate is the minimum rate of return on an investment with theoretically no risk. Government bonds are considered risk-free because technically, a government can always print money to pay its bondholders. Anticipated rate of inflation.

Let's personalize your content