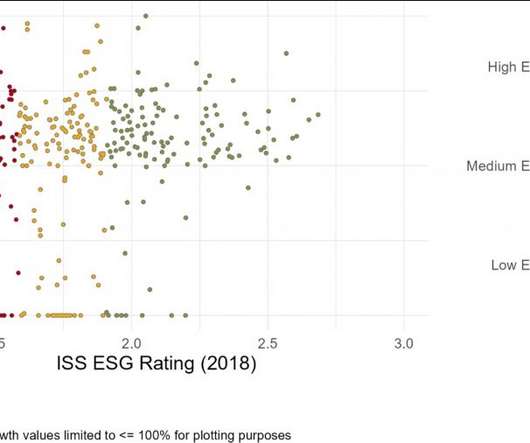

Can High ESG Ratings Help Sustain Dividend Growth?

Harvard Corporate Governance

AUGUST 18, 2022

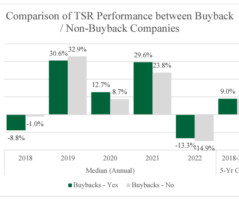

on Thursday, August 18, 2022 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. With US inflation running at a 40-year high and a rocky first half of the year for both equity and fixed income markets globally, uncertainty is high. more…).

Let's personalize your content