Philip Morris International Inc.

Weekly Valuation – Valutico | June 9, 2023

About the company

Philip Morris International, headquartered in New York, is one of the leading global tobacco companies, known for its premium portfolio of products.The company boasts five of the top 15 cigarette brands globally, including the #1 brand, Marlboro. Established in 1847, the company’s influence spans 180 countries worldwide, constantly innovating and expanding to meet the diverse preferences of adult consumers.

Towards a smoke-free future

Under the strategic leadership of CEO Jacek Olczak, Philip Morris is currently transitioning towards a smoke-free future, prioritizing the development and distribution of reduced-risk products (RRPs) like their IQOS heated tobacco system.This venture marks a significant milestone in PMI’s ambitious strategy to derive more than 50% of its total revenues from smoke-free products by 2025.Those reduced-risk products currently represent about 35% of PM’s sales. To further this goal, PMI has expanded its footprint by acquiring several pioneering pharmaceutical companies, augmenting its ability to advance toward a smoke-free future.

Recent Financial Performance

Despite the challenging market conditions, Philip Morris has recently demonstrated a resilient financial performance. Their Q1 2023 results exceeded expectations, reporting USD 1.38 EPS on an USD 8 billion net revenue base, showing a 3.5% revenue increase and 3.2% organic growth. Looking ahead to 2023, the company maintains a positive outlook, anticipating 7% to 8.5% in organic net revenue growth and 7% to 9% in currency-neutral adjusted EPS growth.

Share Price Performance

The company has experienced a diverse range of performance since its public debut in 2008. A notable downturn occurred in April 2018, with the stock plunging 16% due to slowed growth in its IQOS product in Japan, leading to industry-wide concerns. The year 2018 ended with PMI’s stock down by 36.8%, further impacted by a downgrade from Credit Suisse and Altria’s significant investment in e-cigarette company JUUL Labs. However, PMI rebounded in 2019, seeing a 29.7% rise by February. The stock reached its all-time high of USD 104.66 in February 2022 and closed at USD 91.78 on June 08, 2023.

Valutico Analysis

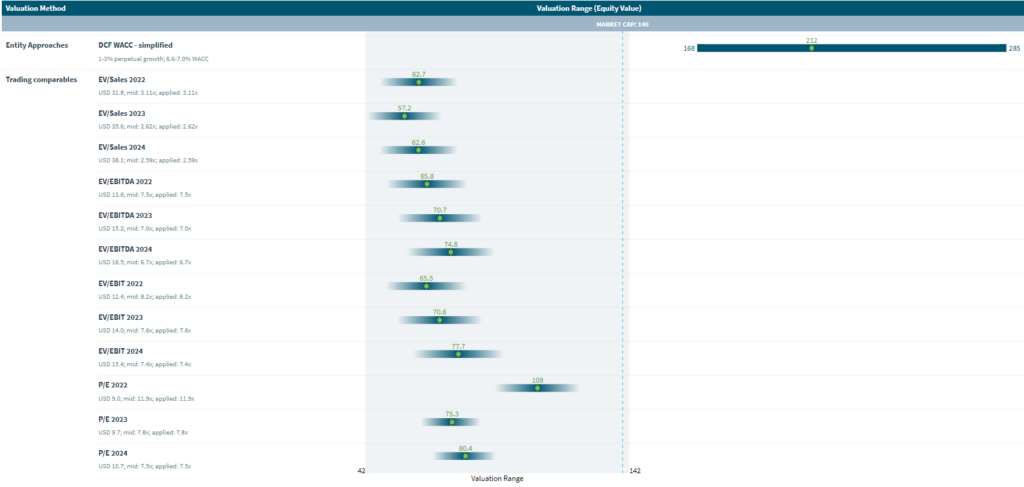

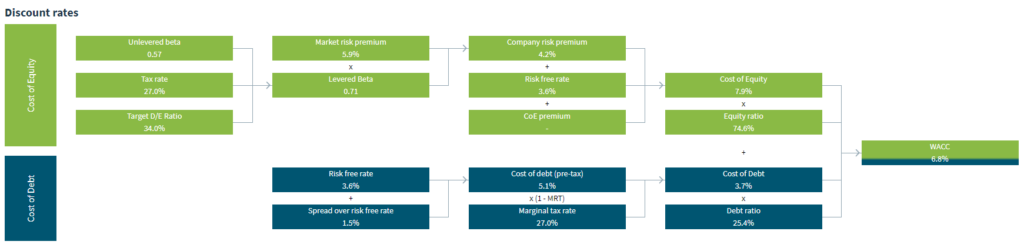

We analyzed Philip Morris International Inc. by using the Discounted Cash Flow method, specifically our DCF WACC simplified approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of USD 212 billion using a WACC of 6.8%.

The Trading Comparables analysis resulted in a valuation range of USD 57.2 billion to USD 108 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as British American Tobacco p.l.c, Scandinavian Tobacco Group A/S and Vector Group Ltd.

Combining our DCF WACC and Trading Comparables analysis results in a valuation range of USD 42 billion to USD 142 billion. In comparison to PMI market capitalization of USD 140 billion we suggest that the company is fairly valued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument