Weekly Valuation – Valutico | June 15, 2023

About the company

NVIDIA Corporation, based in Santa Clara, California, is a leading multinational technology company known for designing state-of-the-art graphics processing units (GPUs) and system on a chip units (SoCs). As a dominant supplier in artificial intelligence hardware and software, NVIDIA’s technologies are used in diverse sectors such as architecture, scientific research, and media. NVIDIA’s impact extends to mobile computing with its Tegra mobile processors, and the gaming industry with its Shield devices and GeForce Now cloud service.

The future of AI technology

The partnership between Microsoft and CoreWeave, established earlier this year, is a strategic move aimed at harnessing substantial computing power for Microsoft’s OpenAI initiative. CoreWeave, valued recently at USD 2 billion, provides accessible Nvidia GPUs known for their prowess in running AI models. This collaboration elevates Nvidia’s role as a vital player in the AI realm. As tech giants compete to incorporate generative AI, inspired by the success of OpenAI’s ChatGPT chatbot, this alliance reaffirms Nvidia’s key influence on the evolution of AI technology.

Recent Financial Performance

In the face of a rapidly evolving tech landscape, NVIDIA continues to make significant strides, registering a substantial quarterly revenue of USD 7.19 billion, marking an uptick of 19% from the previous quarter. The record-setting Data Center revenue reached USD 4.28 billion, underscoring the company’s strength in this vital segment. Even amidst a year-over-year revenue decrease of 13%, the company’s robust non-GAAP earnings per share clocked in at USD 1.09. Additionally, NVIDIA returned USD 99 million in cash dividends to shareholders, exemplifying its financial robustness. As generative AI and accelerated computing become the new industry norms, NVIDIA’s wide-ranging product offerings keep it at the forefront.

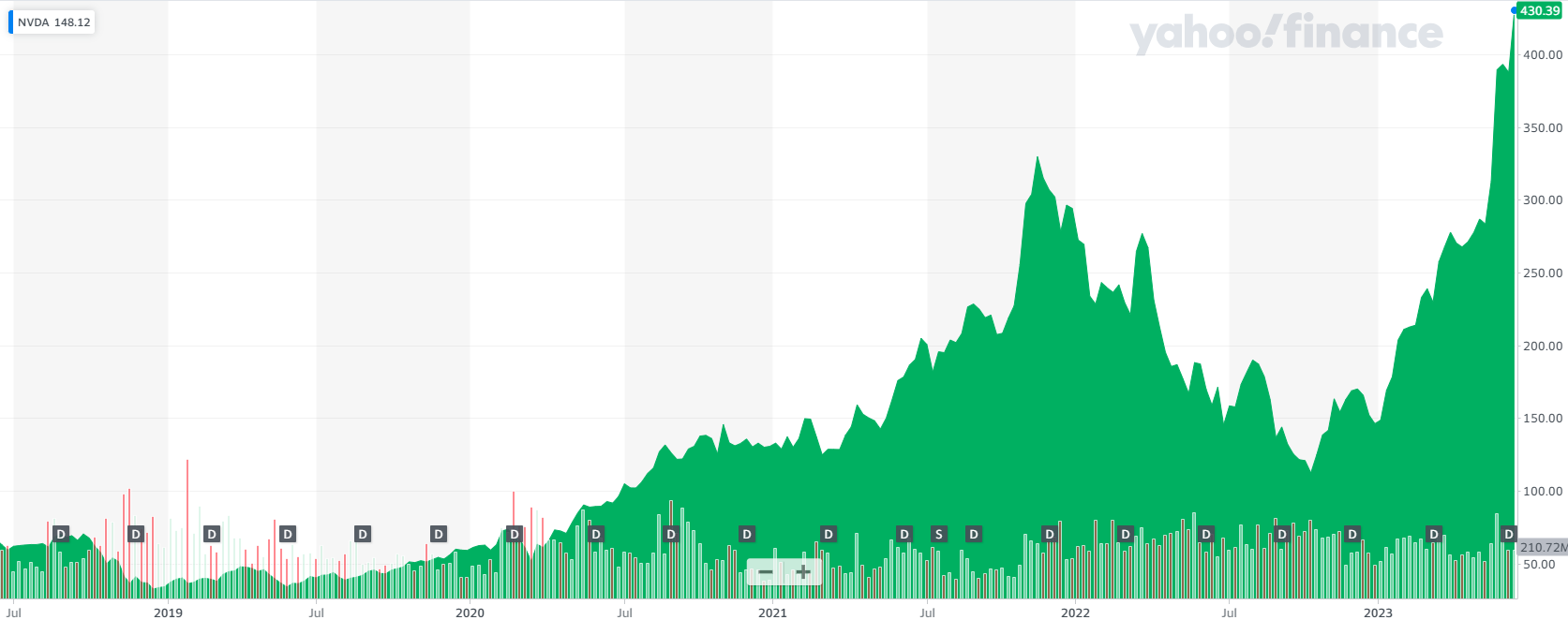

Share Price Performance

In the wake of its first quarter earnings announcement this year, Nvidia’s shares surged a staggering 24% in a single session, subsequently reaching a 52-week peak. The surge is largely attributable to the company’s promising financial outlook, projecting a robust second quarter revenue of USD 11 billion, significantly surpassing analysts’ forecasts. Over the course of the year, Nvidia’s stock has witnessed a remarkable appreciation of over 160% since the close of 2022. Emphasizing the company’s robust market performance, Nvidia’s market capitalization has hit the USD 1 trillion milestone, joining the elite league of tech behemoths such as Apple and Amazon. Reflecting strong Q1 2023 performance and favorable market trends, NVIDIA’s current share price stands at USD 430.39.

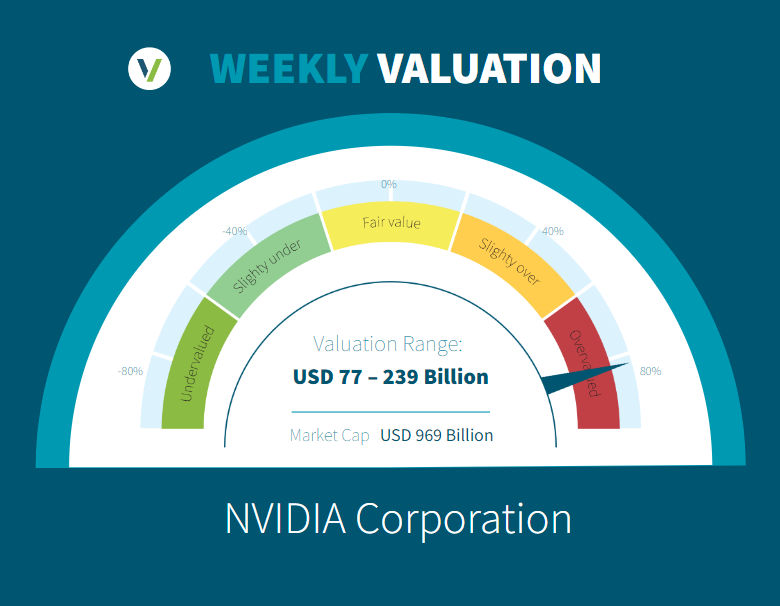

Valutico Analysis

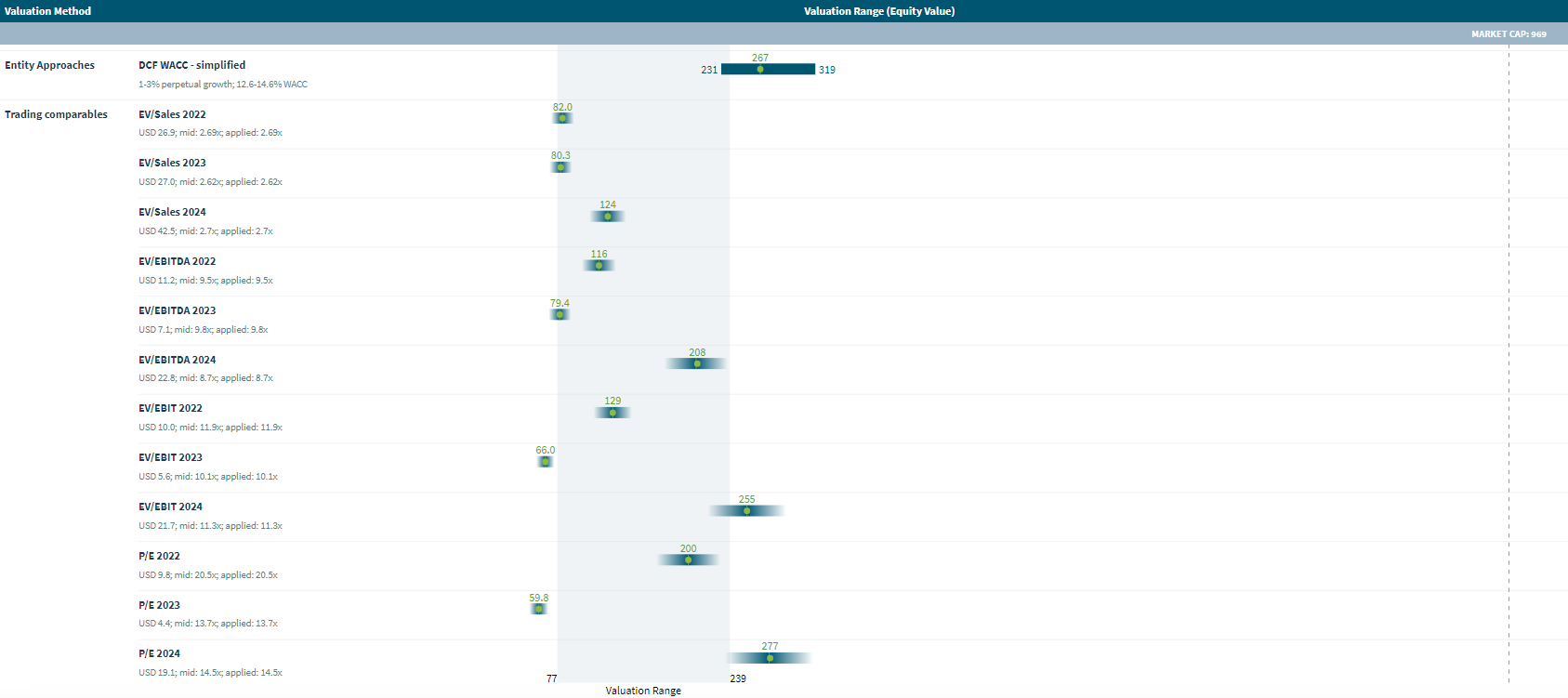

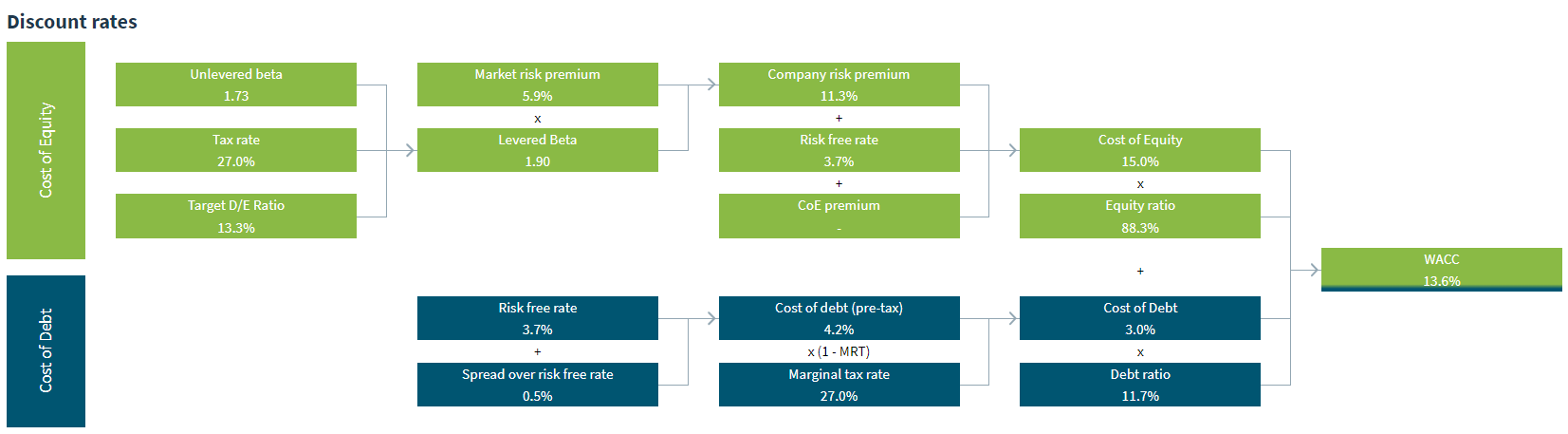

We analyzed NVIDIA Corporation by using the Discounted Cash Flow method, specifically our DCF WACC simplified approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of USD 267 billion using a WACC of 13.6%.

The Trading Comparables analysis resulted in a valuation range of USD 60 billion to USD 277 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Intel Corporation, Advanced Micro Devices, Inc. and Cisco Systems, Inc.

Combining our DCF WACC and Trading Comparables analysis results in a valuation range of USD 60 billion to USD 239 billion. In comparison to Nvidia market capitalization of USD 969 billion we suggest that the company is overvalued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.