Blog 2 of 4:

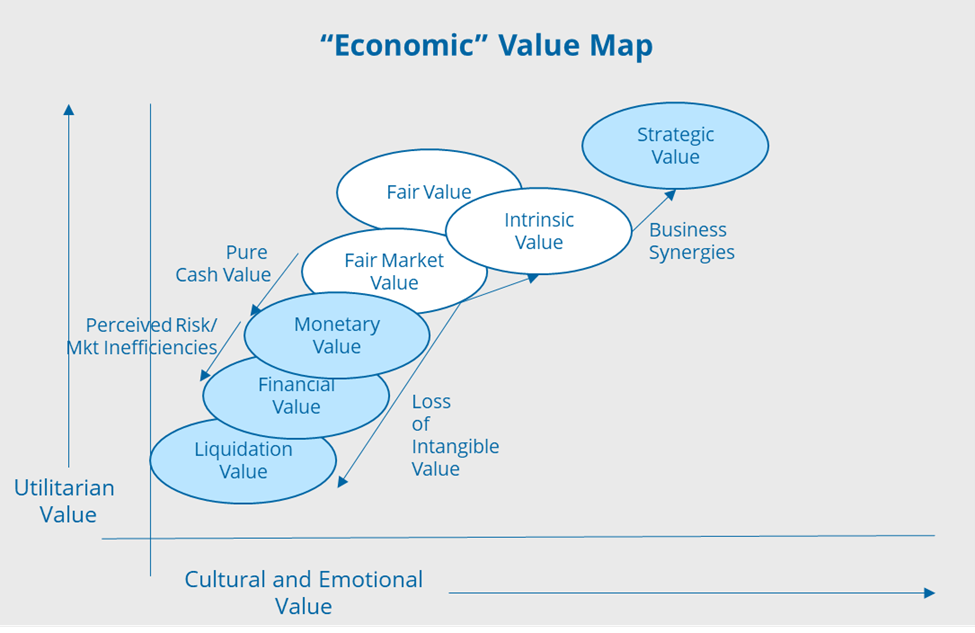

This is the second in a series of blogs that attempts to explain and distinguish between various valuation concepts, such as price, fair market value, fair value, liquidation value, intrinsic value, financial value versus strategic value, monetary versus economic value, emotional and psychic value, among others. Environmental, social, and governance (ESG) value is relatively new, and gaining acceptance in corporate America. Hedonic value has various meanings and uses but is usually thought of as the immediate, emotional gratification (perhaps a cause for impulse buying), as contrasted to utilitarian value.

Many people have heard of the cost, market, and income approaches to valuation, and these various approaches and hybrids can sometimes be applied to determining the different value standards mentioned above. But while valuation (the process of putting a value on something) is part science and part art, there are well accepted techniques, methodologies, and theories that should be adhered to. Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation.

Liquidation, Monetary, Financial, and Strategic Value

The liquation value is simply the FMV without the intangible assets of the business unless certain intangibles such as patents can be separately sold/licensed and utilized by another firm. The monetary value is just what it says, pure cash value without regard to any psychic benefits.

To the typical private equity group (“PEG”), financial value rules – buy low and sell high. It is all about cash-on-cash return. A PEG usually requires higher returns (in part, to compensate for additional perceived risk since a seller will always know more than a buyer); therefore, the financial value is less than the expected monetary value (until they are a seller, of course). PEG buyers also often look for market inefficiencies to achieve superior returns. More often private equity buyers compete with strategic buyers (most often corporate buyers) in that revenue and cost savings synergies accelerate their value creation.

For the complete white paper go to: https://lnkd.in/gtPdGNf

For more information, contact:

Marty Hanan is the founder and President of ValueScope, Inc., a valuation and financial advisory firm that specializes in valuing assets and businesses and in helping business owners in business transactions and estate planning. Mr. Hanan is a Chartered Financial Analyst and has a B.S. Electrical Engineering from the University of Illinois and an MBA from Loyola University of Chicago.

If you liked this blog you may enjoy reading some of our other blogs here.