March 2022 SAAR

The March 2022 SAAR was 13.3 million units, down 5.3% from 14.1 million in February and down 24.4% from March 2021’s SAAR of 17.6 million units. This drop in the SAAR is a product of several factors, one being the low magnitude of the seasonal adjustment. The seasonal adjustment in this month’s SAAR is minimal compared to adjustments made in January and February, as March is typically a bigger selling month in the automotive industry (See below for unadjusted total sales numbers).

Also pulling the SAAR down is production stoppages, as the production of new cars and trucks continues to be limited in the wake of ongoing supply-chain issues and global shocks from the war in Ukraine. More detail on the specifics of auto supply-chain headlines is included later on in this post.

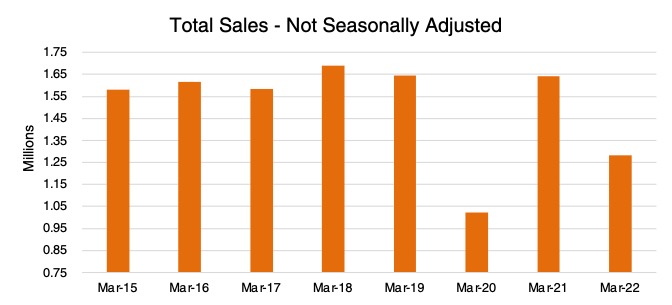

Seasonal Adjustment

Total unadjusted sales over the past month were certainly low compared to previous years, except March 2020 when the COVID-19 pandemic shook up the world economy. Declining sales are not due to a lack of consumer demand, which has been elevated since mid-2021. In fact, consistently heightened demand for vehicles has kept incentive spending low (all-time low of $1,044/Vehicle) and average transaction prices high (March record of $43,737) over the last month.

High sticker prices have increased the average monthly vehicle payment to $658, up 12.4% from this month last year. Rising interest rates in the last several months have compounded the issue, making the purchase of a new vehicle that much more expensive for consumers. Vehicle payments have not increased at quite the rate of sticker prices due to higher trade-in equity values, up 81.3% per vehicle from March 2021.

These conditions come as no surprise. When asked about the last month prior to the SAAR data release, Thomas King, president of the data and analytics division at J.D. Power, commented, “Typically, March is a high-volume sales month with elevated promotional activity because it marks the end of the fiscal year for some manufacturers and the close of the first quarter for others. In March 2021, consumers purchased almost 1.4 million new vehicles at retail. This year, with fewer than 900,000 units in inventory, it will be impossible for the sale pace to even approach last year’s level. Given the strong demand and extremely constrained inventory situation, it should be no surprise that manufacturer discounts are at their lowest level ever, while prices and profitability set records for the month of March.”

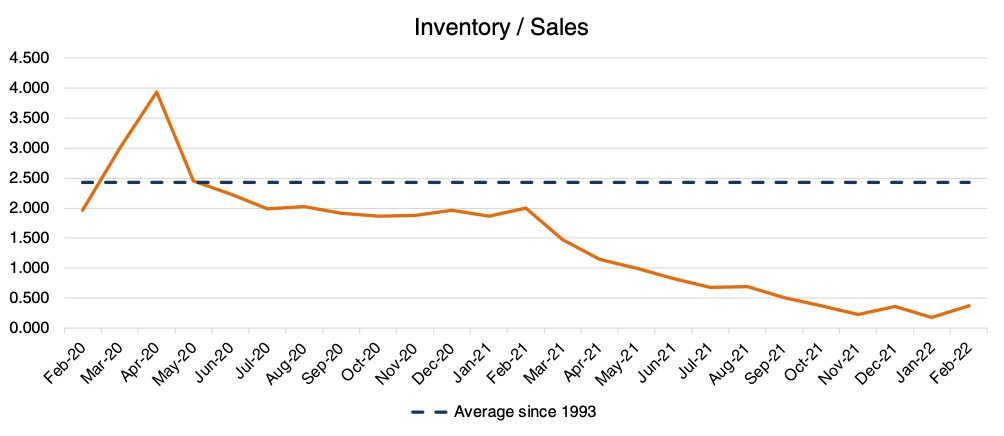

Industry-wide inventory balances for February were released this month, and they revealed virtually no change from the status quo. The industry Inventory/Sales ratio saw a modest increase, but the uptick was primarily due to decreased sales rather than increased inventory. When looking into the individual components of auto inventory in the U.S., domestic auto production and the number of imported vehicles both decreased, making for an all-around lack of vehicles available to auto dealers and their customers.

The War in Ukraine and the Auto Supply Chain

Russia’s invasion of Ukraine and the resulting economic sanctions and reverberations are the latest global events to rock supply chains. The United States government has talked of reeling back globalization in an effort to reduce dependencies on China and Russia in a number of strategically important industries. President Biden has also announced a release of 180 million barrels of oil from U.S. reserves in response to rising fuel prices, given Russia’s place in the oil and gas industry. Furthermore, microchip facilities are under construction across the U.S. as the country makes a concerted effort to become less dependent on off-shore micro-chip producers, which pre-dates the Russian invasion of Ukraine but is certainly relevant. As we’ve discussed before, there is a long lead time to producing microchips, meaning it will still take a while to increase domestic production meaningfully.

Some analysts are projecting around 1.5 million lost units in 2022 as a result of shutdowns, while others are projecting up to 3 million lost vehicles.

To focus on the auto industry in particular, automakers are facing their third supply-chain crisis in the past three years. On a global scale, European auto manufacturers like Volkswagen are being forced to shut down facilities. The company released a statement saying that “With the extensive interruption of business activities in Russia, the executive board is reviewing the consequences of the overall situation during this period of great uncertainty and upheaval.” The fallout is not limited to Europe either, as Toyota, Ford, and Hyundai shut down plants in response to the conflict and have echoed sentiments of uncertainty. According to the Wall Street Journal, some analysts are projecting around 1.5 million lost units in 2022 as a result of these shutdowns, while others are projecting up to 3 million lost vehicles. The point is that visibility is very low.

European OEM facility shutdowns are not the only repercussion of the conflict in Ukraine. Dozens of auto parts makers shut down facilities in the country as well, setting up a ripple effect that could impact automotive plants in every corner of the globe. For example, Ukraine has become a key supplier of electrical wiring assemblies. Western Ukraine is an attractive location for making wiring harnesses and cable assemblies because of the local workforce’s relatively high quality and low cost (it is a labor-intensive activity). It is also geographically situated as a hub between manufacturing plants in Germany and Asia. Likewise, many raw materials used in the production of vehicles are sourced from Ukraine. Oil (used in countless processes) and neon gas (used in the production of microchips) are the two most relevant newly restricted raw materials in the automotive industry.

There is no reliable estimate as to when these supply lines will be re-opened, and the timetable seems long and uncertain to say the least.

Logistical issues have also been magnified amid the invasion. Train, plane, and boating connections have been disrupted or halted in the region, adding additional costs to an already elevated logistics pricing environment. There is no reliable estimate as to when these supply lines will be re-opened, and the timetable seems long and uncertain to say the least.

Another consideration relevant to the automotive industry has to do with trade policy and the global presence of automakers. Since the invasion began, several OEMs like General Motors have gotten out of Russia (financially and physically). The decision to back out of the country came as several corporations across many industries (seemingly) came together to sanction and exclude Russia from economic activity. Many of these companies probably viewed their Russian investments as losing bets once the war started. These actions by OEMs raise an important question: will the doctrine of globalization in auto finally decline after the dust has settled? If that turns out to be the case, will any automakers move back into Russia after the war is over to seize an opportunity?

April 2022 Outlook

Mercer Capital’s outlook for the April 2022 SAAR is pessimistic and consistent with the last several months. Industry supply chain conditions continue to worsen and are expected to decline before they get better. Sales volumes will likely continue to be closely tied to production volumes as vehicles leave lots within days of arrival. Elevated profitability across the entire industry will likely continue as high prices boost margins on vehicle sales. Stay tuned for more updates on next month’s SAAR blog.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights