Q2 2023: RIAs Finish Strong Following June’s Bull Market

Steady Interest Rates Calm Investor Nerves, Boosting RIA Performance

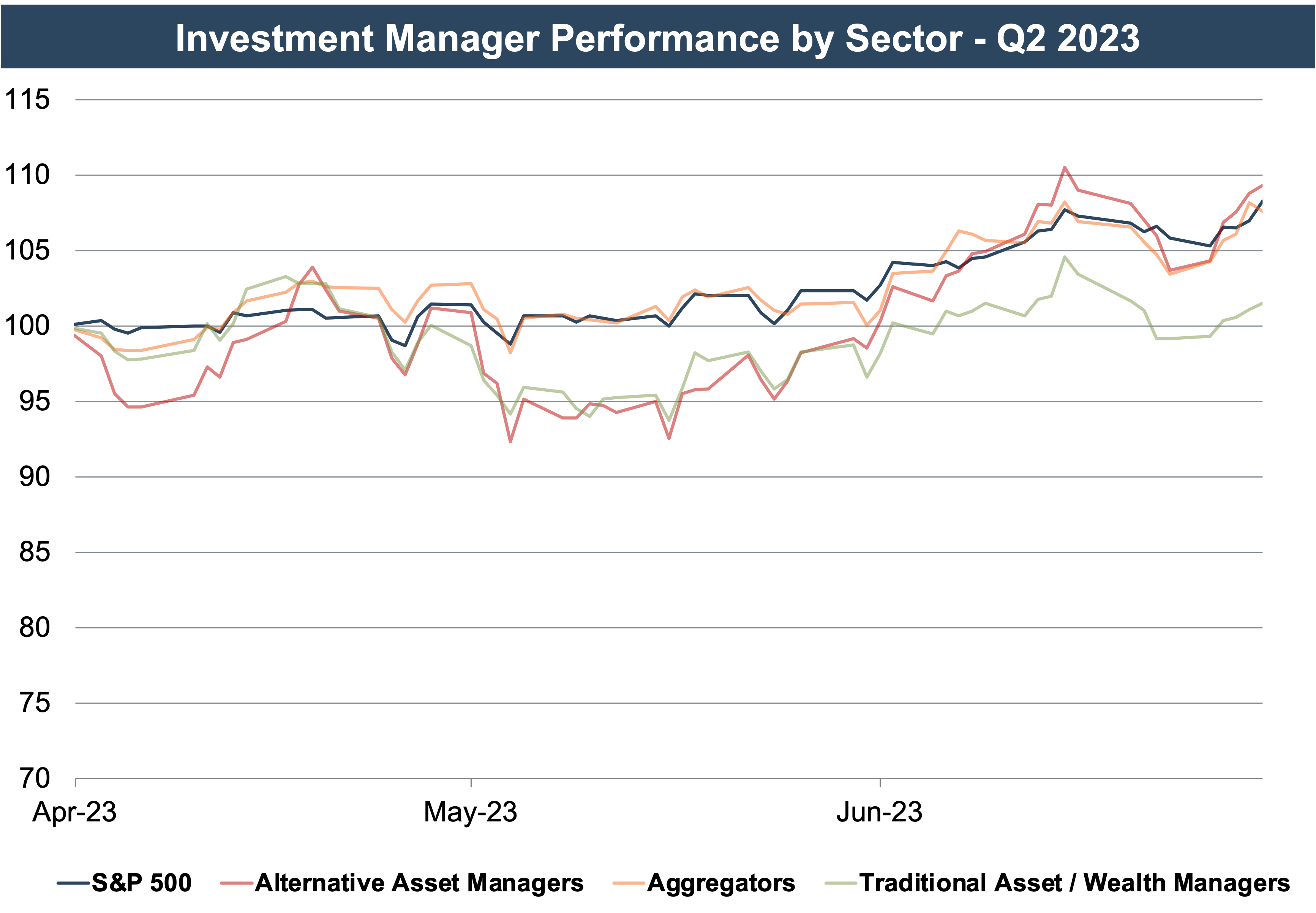

Share prices for publicly traded asset and wealth management firms remained relatively stagnant for most of the first two months of Q2, tracking a broader market that struggled to find direction. In late May, however, the S&P 500 kicked off a summer rally that saw the index enter bull market territory in early June before continuing to notch an 8.3% gain for the quarter. This market uplift propelled AUM balances higher, and share prices for most categories of publicly traded asset and wealth management firms followed suit.

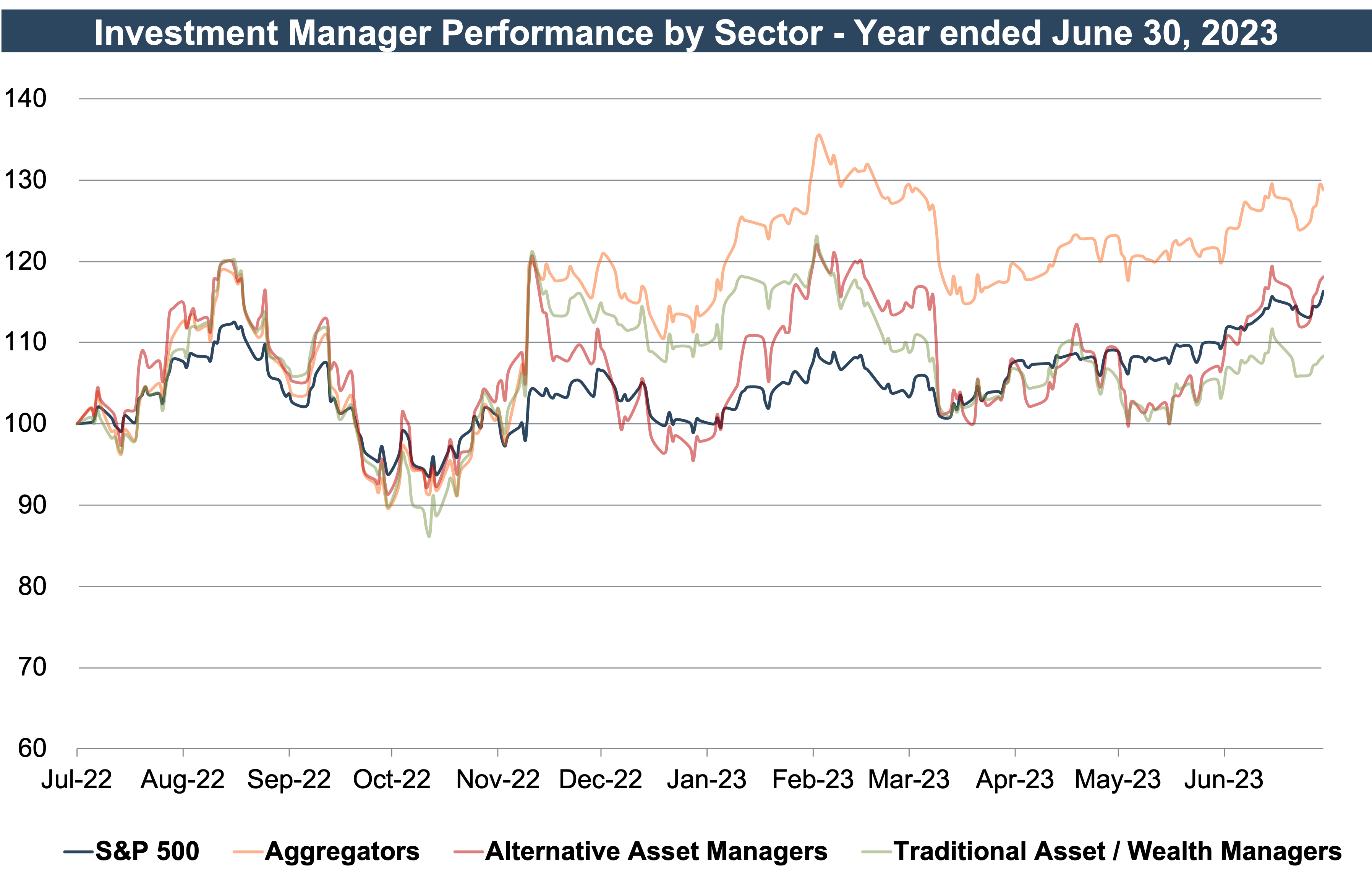

Performance by Sector

The market uptick and calming interest rate environment in Q2 translated to increased prices for public RIAs. Prices for alternative asset managers and aggregators ended the quarter in sync with the S&P 500, while traditional asset managers saw a more modest increase during the quarter. In the last twelve months, most RIA sectors saw a decline in year-over-year earnings, although earnings were not far off the high-water mark set in 2021. Aggregators outperformed other sectors during this period as RIA M&A activity remained elevated.

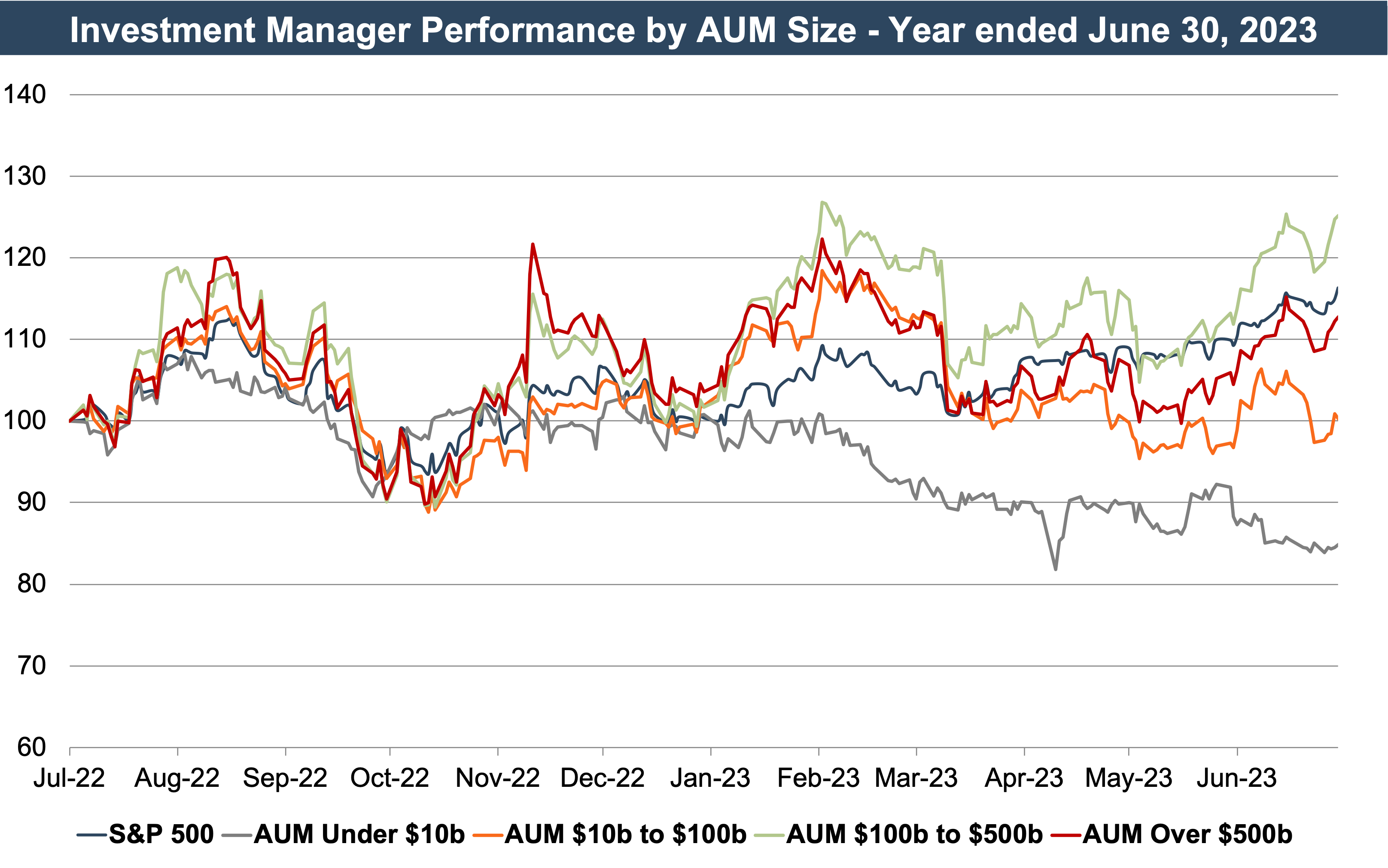

Performance by Size Category

Smaller asset managers (those under $100B AUM) underperformed the S&P 500 quarter-over-quarter and year-over-year. Larger asset managers performed approximately on par with the broader market, with the $100B-$500B AUM group slightly outperforming and the >$500B group slightly underperforming during both periods.

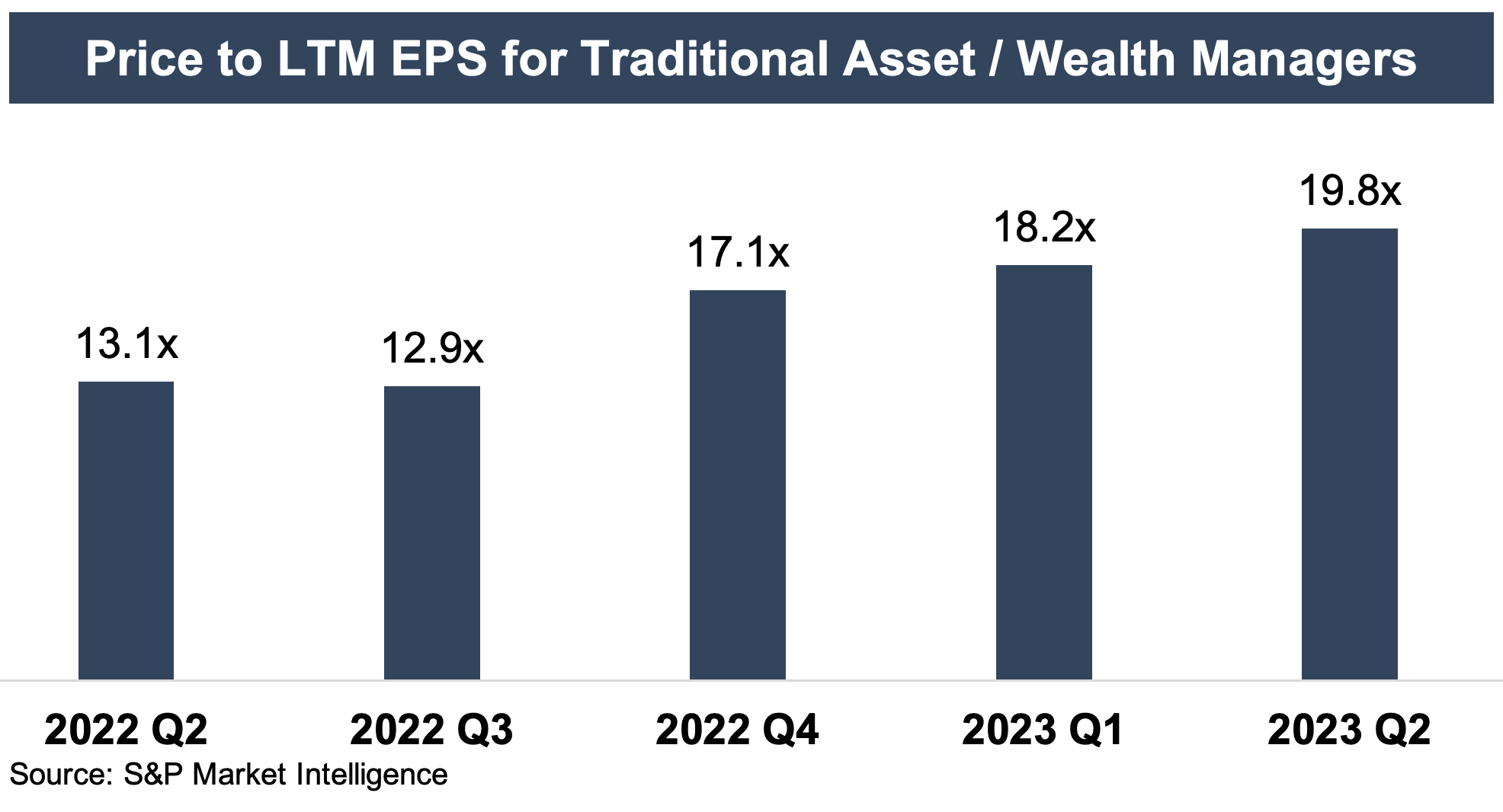

Pricing Trends

The median LTM earnings multiple for publicly traded asset and wealth management firms increased 8.8% during the second quarter of 2023, representing the third consecutive quarter of increases. After trending downwards for most of 2022, multiples began to increase in Q4 and continued to rise in Q1 2023, as LTM earnings metrics began to fully reflect the impact of market conditions in 2022. The multiple expansion in Q2 2023 also reflects the moderating interest rate environment and market rally during the quarter, translating into higher AUM balances and future earnings power for RIAs.

Implications for Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with closely held RIAs should be made with caution. Many smaller publics are focused on active asset management, which has been particularly vulnerable to headwinds such as fee pressure and asset outflows to passive products. Many sectors of closely held RIAs, particularly wealth managers and larger public asset managers, have been less impacted by these trends and have seen more resilient multiples as a result. In the case of wealth management firms, strong demand from aggregators has also helped to bolster pricing in recent years. Focusing on the fundamentals of your RIA—compensation structures, cost controls, hiring practices, etc.—may offer protection from arbitrary changes in market multiples.

In our April M&A update, we described the increase in volume of transactions, both in number of firms and AUM transacted. M&A is often viewed as a lagging economic indicator since deals take several months or even quarters to complete. Later this month, we will report on Q2 2023 M&A activity to keep you informed on market trends.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights