Private Capital Better Than Public for the RIA Community?

It’s Not Supposed to Work That Way, But…

Tesla: A reasonably successful company with a wildly successful stock.

Last month I received an abrupt reminder of the roots of my career when the latest iteration of Shannon Pratt’s “Valuing a Business” landed on my desk. At 1200 pages and weighing in at more than eight pounds, the current installment is the sixth edition of what has been the go-to resource for the business valuation community since Dr. Pratt published the first edition in 1981. Shannon didn’t quite live to see VAB6 in print, but he was available to provide guidance and moral support to me and the other four members of the working group who saw the sixth edition through to completion, and I know he would be happy with the outcome.

While working on VAB6 often felt like a distraction from my day job, it was a useful discipline to remember how the broader finance community views valuation issues outside of the echo chamber of the RIA community. BV still means “business valuation” to the RIA team at Mercer, but there are also “beyond valuation” moments where we’re working on consulting engagements that take us far from our traditional “solve for X” profession. And, leafing through my printed copy of VAB6, I’m reminded of the many times long accepted valuation truths that seem to conflict with observed market behavior.

Is Private Capital Better Than Public for the RIA Community?

Valuation professionals generally accept that public market capital is cheaper and leads to higher valuations than can be achieved by closely-held businesses. The words and actions of market participants who invest in RIAs do not necessarily align with this belief.

In a recent webinar, two heads of prominent private consolidators in the investment management space reflected, indirectly, on this dilemma, noting internal valuations with multiples double that of prominent publicly traded consolidators. One went so far as to say that the public markets weren’t “ready” for the RIA consolidator model.

Anyone can be accused of “talking their book,” but that’s not my point. These moguls are in a good position to understand this, and they are far from alone. The past decade has seen the ascent of more than a dozen privately funded acquirers of investment management firms, many of whom have prospered even while their public counterparts languished.

The news suggests there is no “multiple-arbitrage” available to buy private RIAs with public funding.

Public consolidators appear to be caught in a bind. The recent news that Focus Financial Partners was going to use cash to repurchase up to $200 million in stock (instead of using that same money to buy RIAs) and CI Financial’s announcement that they were “slowing” (pausing?) acquisition activity to focus on integration got our attention.

The news suggests no “multiple-arbitrage” is available to buy private RIAs with public funding. If the evolution of equity ownership can be described as a never-ending search for cheaper capital, the cheapest capital today is not necessarily from public markets.

Why Is This Happening?

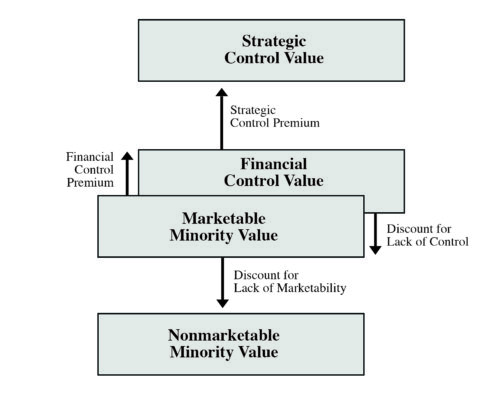

In the valuation world, we use a simple diagram to illustrate the different financial perspectives of public and private investors. It’s known as the “levels of value” chart, and while there are different versions, most generally look something like this:

The “Levels of Value” Chart

The general concept of the Levels of Value chart is the fair market value of equity securities corresponds to the public (or as-if-freely-traded) cost of capital (market risk, or beta), adjusted for idiosyncratic or non-systemic risks associated with a particular company (alpha). That exercise derives a valuation at the “marketable, minority” interest level of value (think public-share equivalent).

Deviations from that anchor point are consequent from factors exogenous to the value of the enterprise. Some acquirers of controlling interests in a business might be able to pay more than the as-if-public price because of issues specific to them – usually operating synergies. Holders of minority interests in closely-held businesses might not be willing or able to pay as-if-freely-traded pricing because of the illiquidity inherent in the shares.

PE relies on financial synergies (cheap capital and long time horizons) to fund their ambitions

This chart is sacramental to the business valuation community, but the reality of the RIA industry suggests it’s more of a tautology. Minority interests in RIAs often sell to institutional investors for multiples that rival control stakes, as the minority investors prize alignment with management control. And consolidators of control stakes in RIAs rarely have operating synergies available to pay premium valuations. Instead, PE relies on financial synergies (cheap capital and long time horizons) to fund their ambitions. Those financial synergies are fueling PE’s competitive advantage when bidding for RIAs.

Is Private Equity’s Advantage in the RIA Space Durable?

Ironically, recent public market volatility appears to be driving more retail investors to private equity from public markets, reinforcing this inversion of the levels of value chart. Will this last? It’s hard to imagine the mass affluent providing a sustainable flow of funds to maintain PE behavior, especially if institutional investors reallocate elsewhere. And PE’s current advantage may be their undoing.

Private equity may be a permanent middle road between public and private ownership, but it’s still subject to the laws of financial gravity.

Entry pricing is, after all, a highly reliable indicator of expected returns. Earning enough to justify premium acquisition multiples requires leverage (financial risk), value-added stewardship (operating risk), superior exit pricing (timing risk), or some combination of the three. Plenty of PE skeptics have already been “early,” and they don’t need me to pile on. But I was raised to profess that public market returns were the logos, the reference point of finance. Our founder, Chris Mercer, had me tape a Levels of Value chart above my desk when I was a junior analyst. Private equity may be a permanent middle road between public and private ownership, but it’s still subject to the laws of financial gravity.

In the summer of 2008, the head of a prominent community bank told me he was grateful his bank was closely-held so he could avoid all the unpleasantness going on in the stock market. That perspective wasn’t durable.

RIA Valuation Insights

RIA Valuation Insights