Is Redemption a Four-Letter Word?

As recently noted in the Wall Street Journal, large public companies are announcing share repurchase programs at a record pace. And, yes, the article includes the usual hand wringing about whether buybacks are “good.” We tend to think that – for public companies – share repurchases are neither good nor bad in themselves. Individual share repurchases may, of course, be ill-advised if, for example, the repurchase price proves to be too high, the resulting leverage imperils the company’s future, or the repurchase crowds out other uses of capital that would generate a superior return. But there is nothing inherently good or bad about share repurchases as such. Repurchasing shares is one of two options companies have for returning capital to shareholders and doesn’t need to carry any philosophical or emotional weight beyond that. For some reason, we don’t recall ever seeing articles bemoaning the level of dividends being paid by public companies.

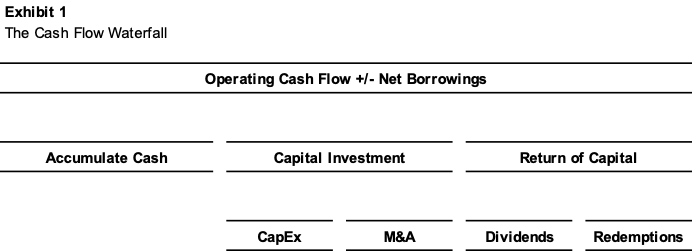

For both public and private companies, share repurchases occupy the same place in the cash flow waterfall, as depicted in Exhibit 1 below.

The operating cash flow of any business (after being either supplemented or depleted by net borrowings or repayments of debt) will be used to do one of three things: (1) add to the company’s cash reserves, (2) be reinvested in productive capital assets, or (3) provide a return of capital to shareholders. The relative proportions of these three uses depend on many company-specific factors including the risk tolerance of the shareholders, the available capital investment opportunities, and the return preferences of shareholders. Whether paid as a dividend to all shareholders, or used to repurchase the shares of some, both strategies are essentially a return of capital. As the news stories consistently point out, share redemptions compete for cash flow with capital investment and cash accumulation. So do dividends.

Like many issues, what is straightforward for public companies becomes a bit more complicated for family businesses. Two factors in particular increase the degree of difficulty for family businesses. First, the motivation for redemptions can be complicated by personal relationships. Second, price is not a given as it is for public companies.

Motivation for Redemptions

Who is the villain here? Too often, families assume that a redemption transaction is a sign of failure and that if there is a redemption there must be a “bad guy.” This does not need to be the case. Shareholder redemptions are not a sign of failure, they are a sign that different family shareholders have different economic profiles, risk tolerances, and return preferences. While those differences are occasionally rooted in some lingering irrational emotional baggage, our experience is that such cases are less common than one might assume. Those circumstances grab the headlines, but most redemption transactions are far more mundane.

Shareholder redemptions are not a sign of failure, they are a sign that different family shareholders have different economic profiles, risk tolerances, and return preferences.

As family businesses mature and shareholders multiply, it is only natural that being a member of the family doesn’t necessarily mean it makes sense for someone to be a shareholder. Taking the emotion out of redemption transactions is the first step to arriving at a healthy outcome: a share redemption is a targeted return of capital that allows family businesses to provide a better “fit” to the economic characteristics of family shareholders. No shame in that.

Price, Value, and the Art of the Possible

The terms of any shareholder redemption transaction include, at a minimum, the number of shares to be redeemed and the price per share to be paid. For public companies, the price is uncontroversial, because the market provides the price every day. The company is no different than any other buyer. In fact, sellers don’t even know if they are selling their shares to another investor or back to the company. And they don’t care.

Without the daily market mechanism, family businesses face a bigger challenge in setting prices. Not only is there no market transparency regarding the value of the company, but the absence of a liquid market for the shares means that the value of the shares to the shareholder is different than the value of the shares to the company.

All else equal, investors prefer ready liquidity. From the perspective of individual minority shareholders in the family business, such liquidity is lacking, which means that the value of those shares to them is impaired relative to the value if the company were publicly-traded. We refer to this decrement to value as the marketability discount, and these discounts are often on the order of 20% to 40% of the “as-if-freely-traded” value of the shares. But the family business is not just any other buyer for the shares – unlike individual family shareholders, the corporate treasury doesn’t really bear the economic burden of illiquidity. So, the shares are effectively worth more to the company than they are to the selling shareholders. Viewed positively, this opens up a range for fruitful negotiations; viewed negatively, this opens up a range for family dysfunction.

A qualified business valuation can establish the range, but it cannot identify the right price for the transaction.

A qualified business valuation can establish the range, but it cannot identify the right price for the transaction. It is up to the family business and the selling shareholders to identify the optimal price within the negotiating range at which to execute a share redemption that accomplishes the goals of the redemption transaction. This moves the discussion from the “science” of valuation approaches, methods, and inputs to the “art” of the possible.

In a future post, we will offer some thoughts on the “art” of the possible, but for now, it will have to suffice to say that successful share redemptions in family businesses are not as rare as you might think, but do require a heavy dose of good faith, a short memory for personal slights (real or perceived), and the ability to keep the end goal in mind throughout the process.

Family Business Director

Family Business Director