How EBITDA Margins Affect Revenue Multiples

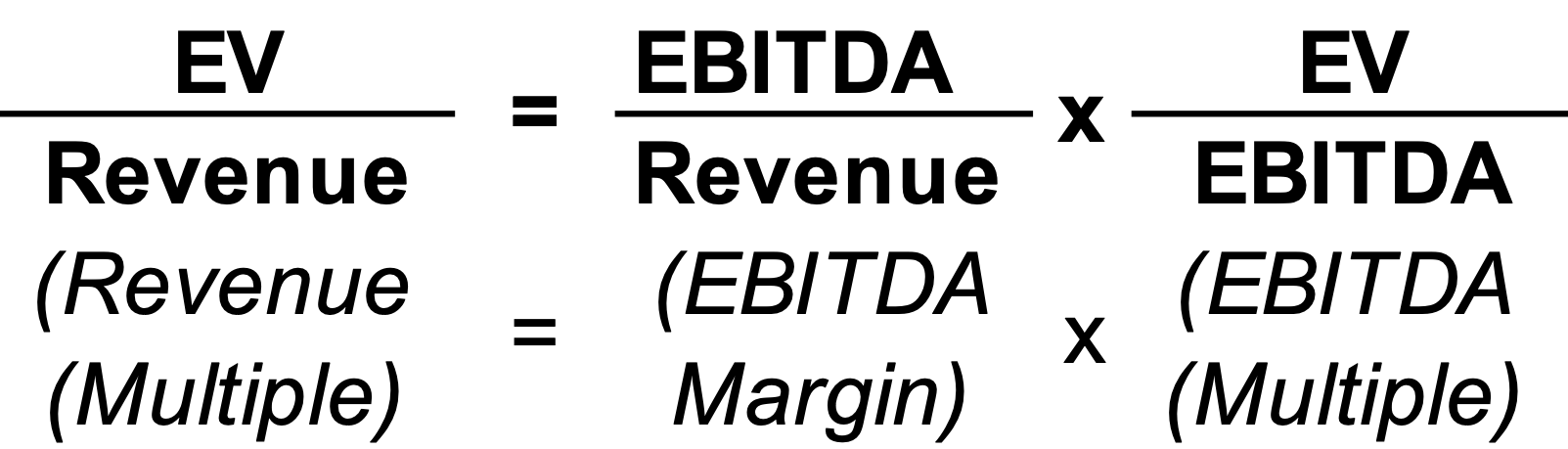

Whenever someone asks me what their RIA is worth as a multiple of revenue, I respond by asking about their firm’s EBITDA margin. My response is largely driven by the math behind the enterprise value (EV) to revenue ratio. The revenue multiple can be decomposed like this:

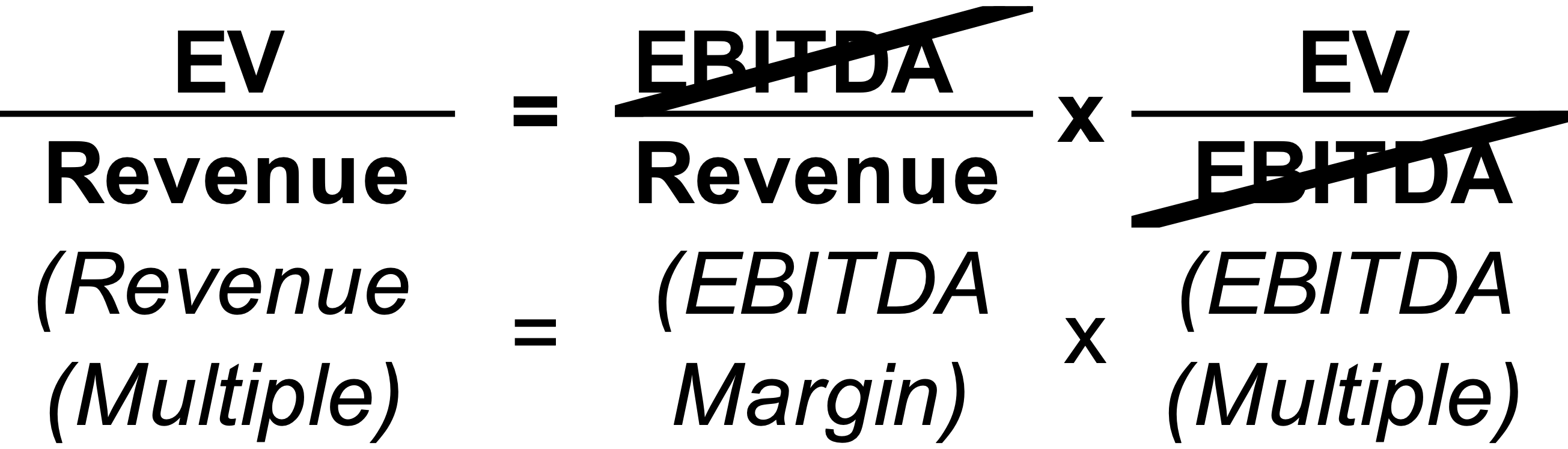

Thinking back to your pre-algebra days, the EBITDAs on the right side of the equation cancel, such that the revenue multiple (EV divided by revenue) is simply the EBITDA margin (EBITDA divided by revenue) times the EBITDA multiple (EV divided by EBITDA):

From a more practical standpoint, a dollar of revenue is worth more when it yields higher returns (earnings) to capital providers (all else equal). Investors will pay more for an RIA’s revenue when there’s more cash flow behind it.

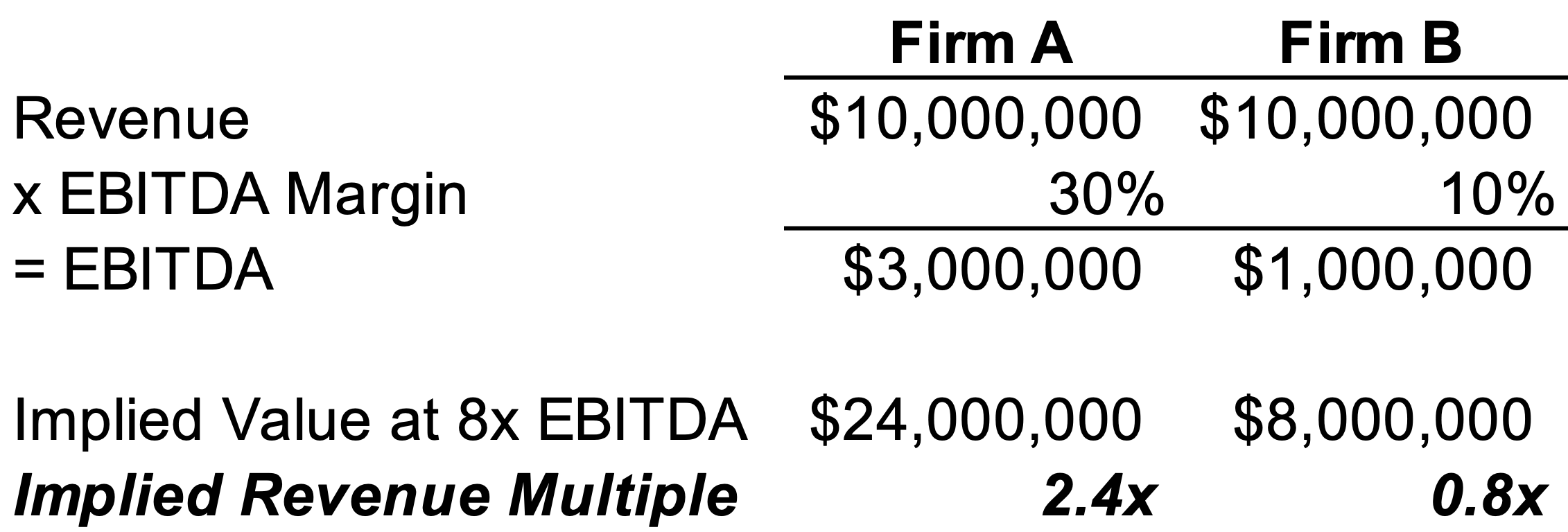

This reality is why we see such disparity in the multiples paid for investment management firms. Take two RIAs with the same level of revenue but different expense structures and EBITDA margins. Firm A has lower personnel and overhead costs, so its profit margin is considerably higher than Firm B’s.

Let’s see what their implied revenue multiples are assuming the same EBITDA multiple valuation:

Firm A’s revenue multiple is three times that of Firm B’s strictly because of the disparity in profitability. We’ve seen even wider ranges of revenue multiples, and it’s usually attributable to differences in the margin.

If you’re an RIA principal looking to improve the value of your management fees, you can either enhance your firm’s profitability or look for ways to bolster your firm’s EBITDA multiple in the marketplace. Both of these levers have elements that are largely outside of your control (market conditions can impact both profitability and multiples), but there are also elements that are inside your control. It’s that latter category that’s worth focusing on.

There are plenty of areas inside your sphere of control that can be addressed to improve profitability: hiring practices, new business development initiatives, incentive compensation structure, operating efficiencies, cost controls, and more. The flip side is that margin-enhancing initiatives in these areas often come with the tradeoff of lower expected growth. All else equal, lower growth means a lower EBITDA multiple.

How do you navigate this tradeoff? Going all in on one lever (maximizing growth at the expense of profitability or maximizing profitability at the expense of growth) is unlikely to be the optimal strategy. The former means a growing stream of losses, while the latter means stagnation (and stagnation is the first step to moving backward). Finding the right balance between growth and profitability is not so different from other investment decisions. An investment in one over the other will have a cost but also expected returns. Making the right investments to develop new business cost-efficiently is key to increasing margins and organic growth in almost any market environment. It will also improve your revenue multiple and value by extension.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, and alternative asset managers.

RIA Valuation Insights

RIA Valuation Insights