Dividends, Shareholder Signals & Present Value

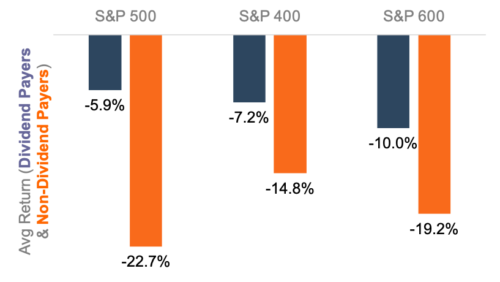

As market and financial data for 2022 continue to roll in, we are beginning to prepare for our annual benchmarking study. One early finding is that investors clearly distinguished between companies that pay dividends and those that don’t. Across the size spectrum, investors favored dividend-paying stocks in 2022, as illustrated in Table 1.

Table 1 :: Average Returns by Dividend Status

While it was a down year across the board, the average return for companies that paid dividends was less negative than those that did not. In this post, we explore two potential reasons for this outcome and the lessons for family business directors.

Lesson #1 – Dividends are a powerful signal to shareholders

Actions speak louder than words, and dividends speak louder than slide decks. Dividends tell shareholders what time it is and what the future looks like.

- Paying a dividend—or not—tells shareholders whether it is planting time or harvesting time. The implicit signal from non-dividend payers is that the company has more attractive investment alternatives than available capital (i.e., it’s planting time). However, dividend payers are communicating to shareholders that they are generating more cash flow than can be responsibly reinvested (i.e., it’s harvesting time).

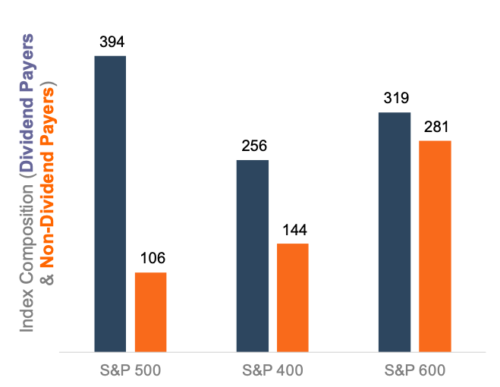

We can confirm this in general terms by looking at the prevalence of dividend payers among the small-cap (S&P 600), mid-cap (S&P 400), and large-cap (S&P 500) indices. As shown in Table 2, nearly 80% of the large-cap companies in the S&P 500 paid dividends in 2022, compared to just over half of the small-cap companies in the S&P 600.

Table 2 :: Prevalence of Dividend Payers by Index

As companies grow and mature, they often use dividend payments to signal to shareholders what time it is.

- Second, companies can use dividends to signal to shareholders what they believe the future holds. Stock prices are all about expectations for the future, not what has happened in the past. Companies tend to only change dividends when they believe the new level will be sustainable, so investors interpret dividend changes as powerful signals regarding management’s confidence in the company’s performance going forward.

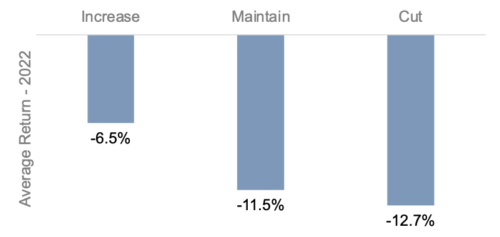

Table 3 :: 2022 Return by Dividend Change

As shown in Table 3, those dividend payers that increased dividends during the year outperformed those that maintained or reduced their dividends during 2022.

So what is your family business’s dividend policy telling your family shareholders about what time it is and what the future holds for your family business? As we have often remarked, shareholder letters may or may not get read, but dividend checks always get cashed. Are your dividend actions aligning with your words about the family business’s circumstances and future prospects? If not, there is a good chance you are eroding credibility and trust with your family shareholders, and credibility and trust are the lifeblood of successful and sustainable family businesses.

Lesson #2 – Dividends reduce shareholder risk

Markets are complicated, and returns are influenced by many factors. However, at the risk of oversimplifying, stock prices fell in 2022 because higher interest rates increased the cost of capital for businesses. As the Wall Street adage says: “Don’t fight the Fed.”

Rising interest rates do not affect all investments equally, however. The longer investors have to wait to receive cash, the more sensitive an investment is to interest rates. A steady dividend stream shortens the “duration” of investments in dividend-paying shares relative to non-dividend-paying shares. So, in a rising rate environment like 2022, basic present value math suggests that dividend-paying stocks will outperform.

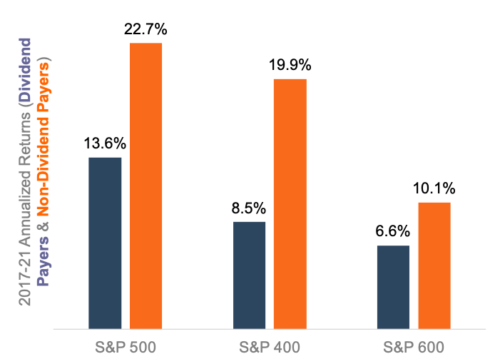

But one shouldn’t expect that what worked in 2022 will not always work going forward. Table 4 summarizes average annualized returns for the same group of companies for four years ending December 31, 2021. Over this period, during which the federal fund’s effective rate fell from 1.42% to 0.08%, returns for dividend payers lagged those of their non-dividend paying peers.

Table 4 :: Annualized 2017-2021 Returns by Dividend Status

Dividends reduce risk (and upside potential) for public company investors. What about your family shareholders? What role do dividends play in managing the investment risk of your family shareholders?

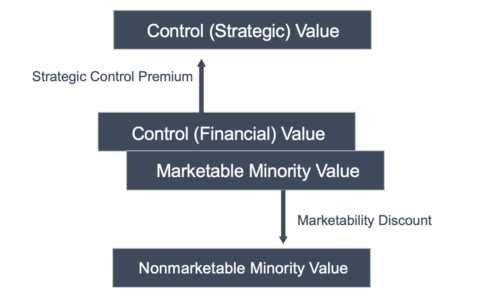

We’ve written previously about how your family business has more than one value. Of the three “values” of your family business at any given time, the lowest is the value of a minority (non-controlling) position in shares that is not readily liquid, as depicted in Table 5.

Table 5 :: The Levels of Value

The “marketability discount” in Table 5 measures the economic burden of illiquidity commonly borne by family shareholders. The magnitude of that discount is not the same for all family businesses. Rather, it is a function of several factors, prominent among which is the amount of expected future dividends. As markets demonstrated in 2022, dividend payments mean that investors don’t have to wait as long to receive a return on their investment. For family shareholders facing an uncertain but potentially lengthy holding period, regular dividend payments ease the burden of illiquidity.

Conclusion

Your family business’s dividend policy is sending a signal to and is affecting your family shareholders’ risk (and potential return). Are you and your fellow directors being intentional about the signals sent by your dividend? Are you incorporating the risk-return tradeoff for your family shareholders in your dividend policy deliberations? Intentionally crafted or not, all family businesses have a dividend policy: is yours sending the right signals?

Mercer Capital has worked with family businesses in crafting their dividend policy. Let us know if you have questions about your dividend policy and the message it is sending your family shareholders.

Family Business Director

Family Business Director