Decisions, Decisions: 3 Questions to Start Thinking About Capital Structure

Elevated interest rates and inflationary pressures have squeezed margins and hindered the liquidity of companies paying down debt. Since the pandemic, lenders have observed a shift from cash flow-based loans towards asset-based loans as companies look to recover flexibility in the face of an uncertain economic outlook. As noted in The Wall Street Journal, this phenomenon is nothing new. This emerging trend suggests that companies are reevaluating their capital structures and debt profiles to prepare for the potentially rocky road ahead.

As economic uncertainty surrounds future cash flows, banks may be more inclined to approve a loan secured by an asset as opposed to a pure cash flow-backed loan. In 2022, the number of asset-based loans increased 10% on top of a 9% increase in 2021. Against this backdrop, family business directors do well to evaluate the current and future needs of the company, with a view to which assets would serve as adequate collateral in the eyes of a lender.

Capital structure decisions are unique to each family business as they are highly dependent on shareholder preferences and distinct business characteristics. No matter what the current capital structure of your family business is, knowing and understanding the makeup of your family business’ balance sheet is critical in devising a plan that can withstand economic disruptions. In this post, we discuss three questions that family business directors should ask themselves today.

What Is the Company’s Current Capital Structure?

All companies have a capital structure, even if the board has never directly considered the optimal capital structure for their family business. Directors evaluate capital structure with an eye toward identifying the financing mix that minimizes the weighted average cost of capital. The iterative nature of capital costs complicates this decision: the financing mix influences the cost of the different financing sources. While the nominal cost of debt is always less than the nominal cost of equity, the relevant consideration for directors is the marginal cost of debt and equity, which measures the impact of a given financing decision on the overall cost of capital. With increasing interest rates and tightening margins making it difficult to accurately project cash flows, it may be time to re-evaluate what is optimal for your family business. The uncertainty surrounding these future cash flows has prompted companies in some sectors to move into asset-based loans, giving companies with strong balance sheets access to cheaper sources of financing.

What Is Your Company’s Available Borrowing Capacity?

Many family businesses are debt-averse. Capital structure is a function of, among other things, family risk tolerance. Yet, there is a difference between a family business preferring to operate without debt and one maintaining a cash balance sufficient to meet every potential contingency. The prudent move for debt-averse families is to maintain and update credit facilities that will allow the business to handle sudden cash needs that may arise without carrying unwieldy cash balances that weigh down investor returns. Even families that prefer not to use debt should acknowledge their ability to issue debt in the future if needed. That borrowing capacity should not be ignored in risk management discussions. Ignoring the available borrowing capacity of the family business can lead to an exaggerated sense of how much liquidity the company needs to maintain on the balance sheet.

How Does the Company’s Capital Structure Compare to Peers?

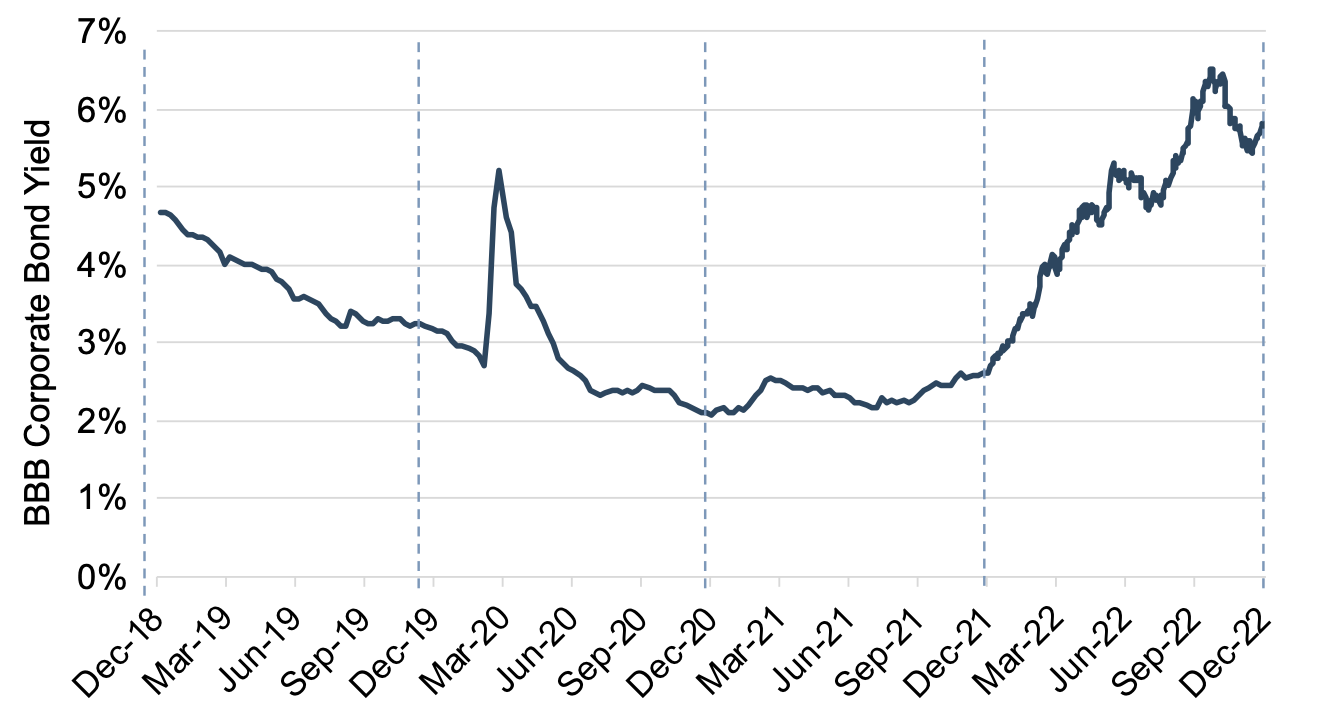

While there is no cut-and-dry formula to answer the capital structure question, family business directors should consider the capital structure of industry peers. Per our 2023 Benchmarking Guide, the capital structures of the benchmarking group are sensitive to macroeconomic factors (i.e., higher borrowing costs). Rising interest rates from 2021 to 2022 impacted leverage ratios as well as the Company’s borrowing capacity and appetite. Most industries saw their debt-to-EBITDA ratios decline as companies grew wary of taking on additional debt amidst higher borrowing costs.

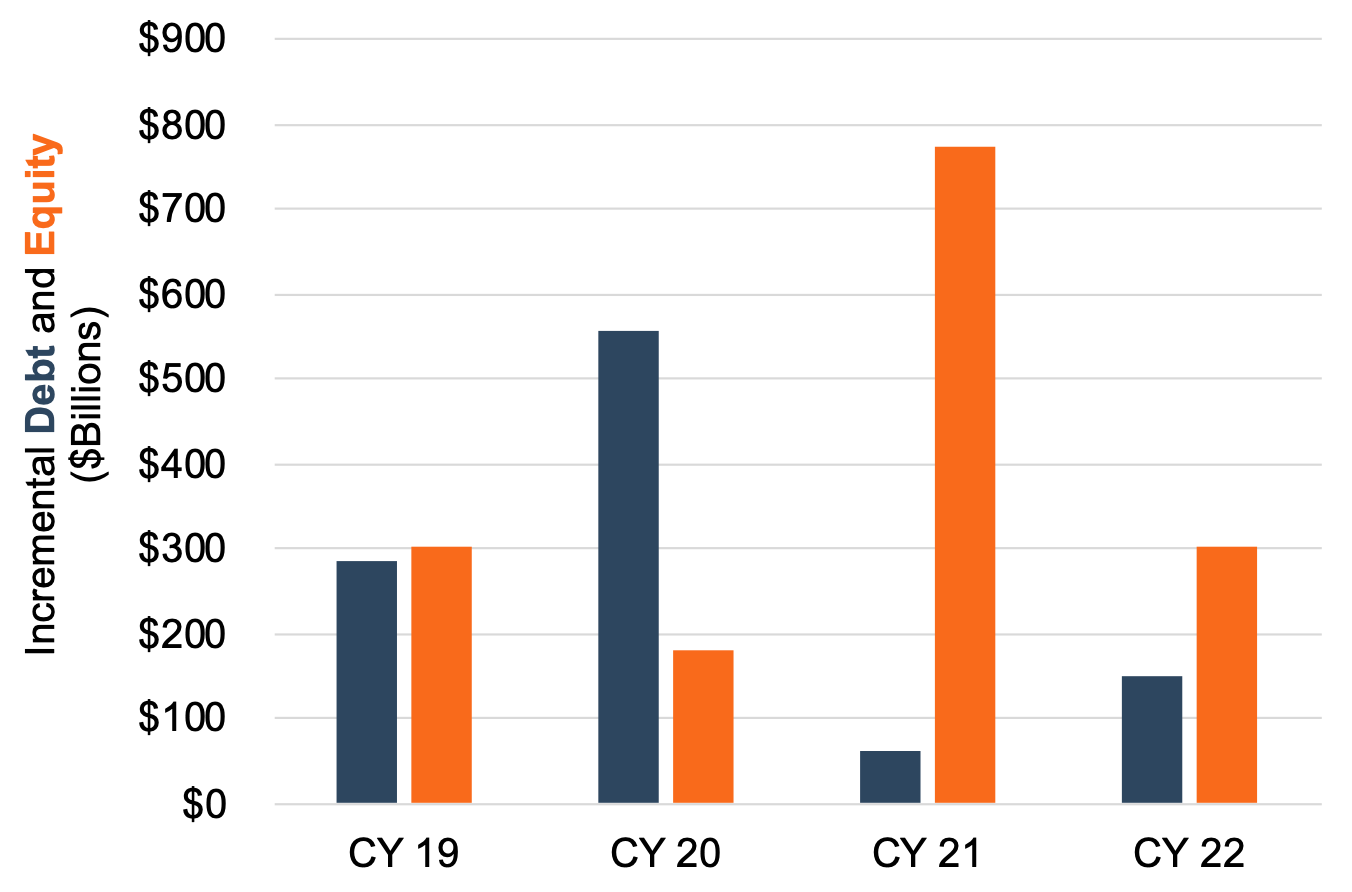

Marginal Funding Sources

Annual Changes in Invested Capital Balances

As depicted above, the companies in our sample borrowed most aggressively in 2019 and 2020, with historically low interest rates. Companies relied on incremental equity financing in both 2021 and 2022 in light of rising interest rates. Benchmarking helps provide valuable context to family business directors when making critical decisions.

Capital structure decisions are crucial to the longevity of a family business. By addressing questions about available borrowing capacity, current capital structure, and peer comparisons, family businesses can be better equipped to make optimal capital structure decisions.

Family Business Director

Family Business Director