One Dealer Is Not Like the Other

Independent Dealers Industry Segment Highlight

In August 2022, we wrote a blog about the Powersports dealer segment of the auto industry, comparing and contrasting it to the franchised dealers that we spend most of our time writing about. This week, we highlight another segment of the auto dealer market: independent dealers. We will continue this series on auto industry segments in the coming weeks.

What Is an Independent Dealer?

Three common examples are high-end luxury or classic car independent dealers, middle-market independent dealers, or Buy Here Pay Here (“BHPH”) dealers.

By definition, an independent dealer does not have an affiliation or association with a particular franchise. In practice, independent dealers are used car dealers that might focus on a particular segment of the market or types/levels of automobiles. Three common examples are high-end luxury or classic car independent dealers, middle-market independent dealers, or Buy Here Pay Here (“BHPH”) dealers.

High-end independent dealers usually focus on luxury brands, classic/vintage automobiles, or high-dollar automobiles. Their target demographic is generally folks with high disposable incomes and/or automobile collectors and enthusiasts.

Middle-market independent dealers focus on middle-class individuals seeking to purchase a used car who don’t want to do so at a franchised dealer, either due to a bad experience at a franchise dealership or an assumed better experience, usually based on convenience or price.

Finally, BHPH dealers are focused on lower-income consumers looking to either pay cash or finance the vehicle directly from the BHPH dealer. As such, BHPH dealers typically inventory later model vehicles with higher mileage totals and/or popular makes of automobiles that turn quickly. BHPH cater to the subprime market, offering financing not offered by more traditional dealers; dealers offering this financing are sometimes said to “tote the note.”

Independent Dealership Statistics

Published statistics of the independent dealers segment are harder to locate than similar statistics for franchised dealers. This is partly because franchised dealers are required to report their financial statements monthly to the manufacturer, so this data is more uniform and accessible for comparative purposes. Most independent dealer experts estimate the number of independent dealers to be around 27,000 – 30,000. However, this estimate includes not only physical independent dealerships but also individuals who file with the IRS and identify as a used car dealer. Other estimates of physical used car/independent dealers put the count between 16,000 and 17,000.

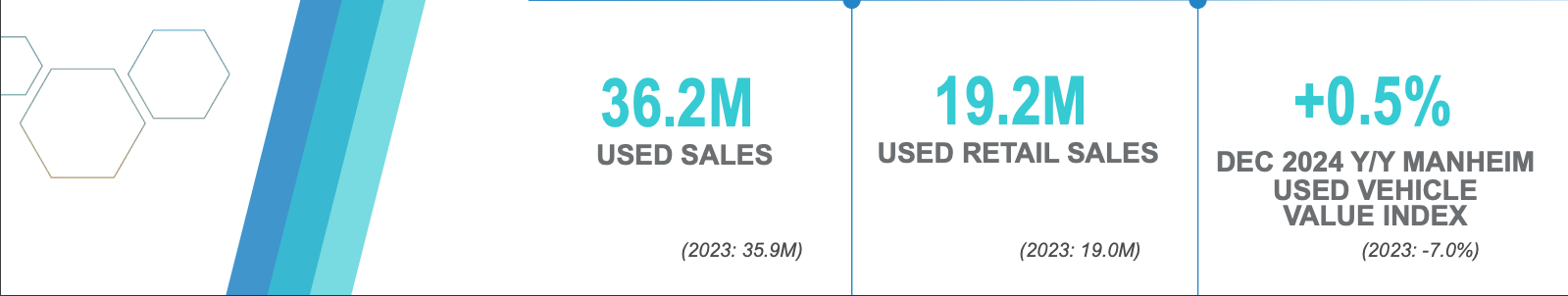

According to Cox Automotive’s 2024 Industry Insights Webcast, they expect the entire used car segment to generate 36.2 million unit sales in 2024, compared to 35.9 million unit sales in 2023. On the retail front, Cox predicts 19.2 million of those used units will be retailed in 2024, compared to 19 million retailed in 2023. Finally, Cox estimates that based on the year-over-year change in the Manheim Used Vehicle Value Index, the value of used cars will increase slightly by 0.5% versus a decline of 7% from 2022 to 2023. See the graphic below:

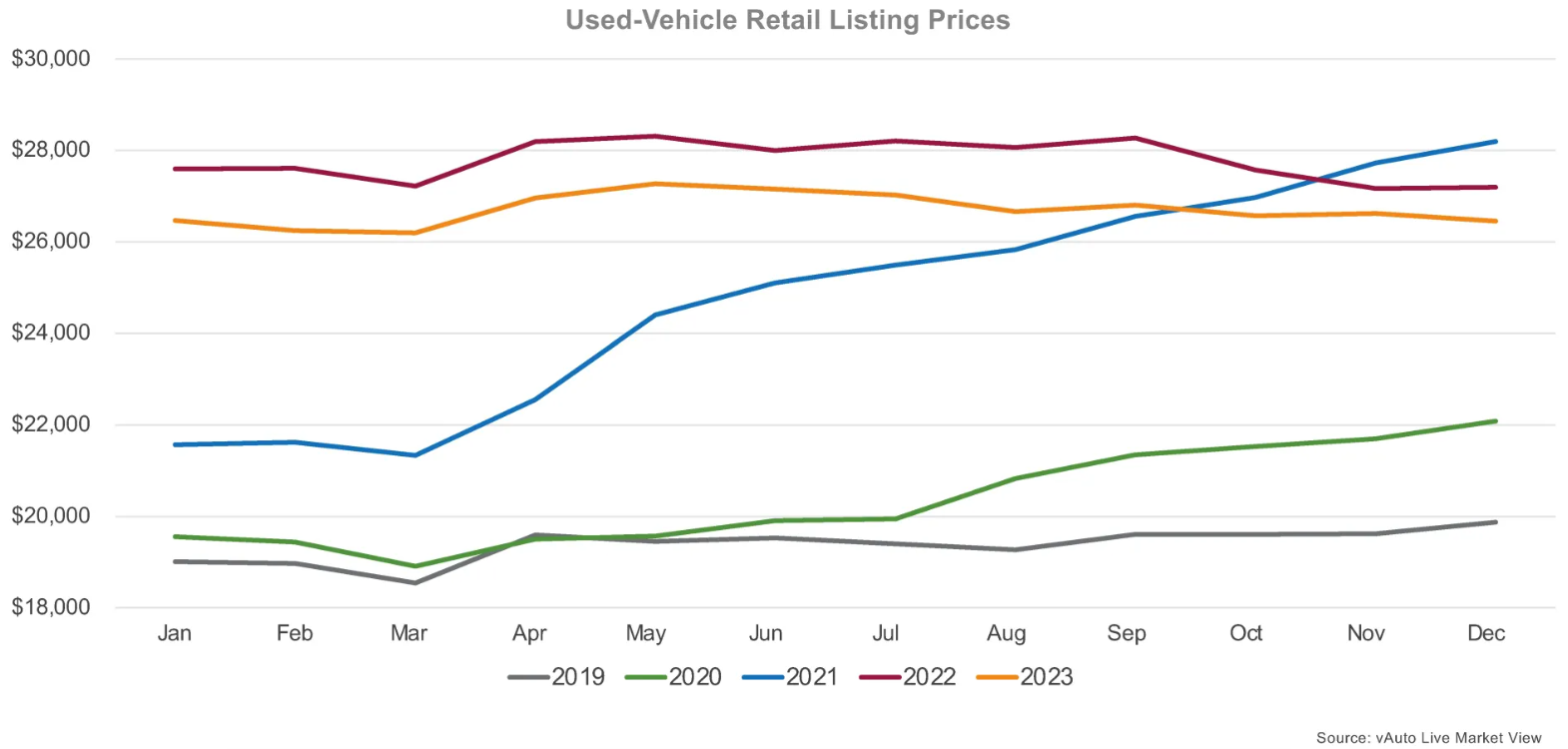

Further evidence of increased value can be found in the following graphic from Cox Automotive’s 2023 Market Insights and Outlook, as list prices for retailed vehicles declined in 2023 compared to 2021 and 2022 levels:

Similarities to Franchised Auto Dealers

Departments/Profit Centers – Most independent dealers have a few of the same departments and profit centers as franchised dealers, but generally not all four: new vehicle, used vehicle, service/parts, and finance/insurance. As we mentioned earlier, independent dealers do not retail new vehicles. Like franchised auto dealers, independent dealers source most of their cars from auto auctions or direct sales (including trade-ins) from consumers that fit their target/strategy. Some independent dealers have service/parts, but for most of them, the service is more basic/confined to oil changes, tires, and other services to refurbish the vehicles into better condition for resale. Finally, not all independent dealers offer financing, while others (particularly BHPH) offer financing directly from the owner/dealership.

Floor plan limits tend to be lower for independent dealers than franchised dealers

Floor Plan Inventory – Like franchised dealers, independent dealers acquire their inventory through floor plan lending, which enables them to display more vehicles on the lot for purchase. One distinct difference is that independent dealers generally rely on different sources of floor plan financing. Instead of financing arms from manufacturers such as Ford Motor Credit or Toyota Credit, independent dealers rely on regional banks and firms like NextGear Capital. Floor plan limits tend to be lower for independent dealers than franchised dealers and can constrain the number of vehicles on the lot and the dealership’s overall profitability. In the volatile used vehicle pricing environment, the marketplace for floor plan financing has been dynamic.

Industry Terminology – The value of an independent dealership is typically reflected in a single dollar value and as a reflection of Blue Sky or intangible value. As with franchised auto dealers, Blue Sky value can be expressed as a multiple of normalized pre-tax earnings. One distinct difference in independent dealerships is the lack of published Blue Sky multiples. The lack of published multiples makes the valuations, specifically the market approach, more difficult for independent dealers. This stands to reason as the strategy/value proposition is more variable than an investor might expect when purchasing a Ford store, for example.

Recent Industry Conditions – Over the last few years, inventories have also been constrained like traditional automobiles due to the availability of used vehicles during COVID and post-COVID, as many fewer vehicles were traded in and became available on the secondary market. Independent dealers are also impacted by the rising costs of used vehicles, just as franchised dealers were selling their used vehicles. Constrained production from 2020-2022 will ripple through the used vehicle market, impacting independent dealers either now or in the future, depending on their strategy. For example, BHPH are more likely to feel this constraint in the future as 2021 vintage models age.

Differences from Franchised Auto Dealers

Dealer Agreements – Unlike franchised auto dealers, independent dealers do not have formal agreements with the vehicle manufacturer. Following the same theme, independent dealers are not afforded area protection or area of responsibility (“AoR”) and can experience heightened competition with other independent and franchised dealers, as there are lower barriers to entry (a proven track record and access to capital being the greatest limiting factors).

More Dependent on Macroeconomic Factors – Since most of the purchases in used cars involve lower to middle-class consumers, independent dealers are more susceptible to macroeconomic factors such as the state of the economy and unemployment rate. During periods of stagnant growth, recession, or high inflation/interest rates (like we have been experiencing for the better part of the last year), independent dealers experience a greater impact from these conditions than their franchised dealer counterparts.

Since independent and particular BHPH dealers interact with lower-income consumers, collections are more critical than franchised dealers.

Collections – Since independent and particular BHPH dealers interact with lower-income consumers, collections are more critical than franchised dealers. BHPH are subject to more risk as they are basically financing all of the vehicles that aren’t purchased with cash. As a consequence, repossessions enter the picture. Both the possibility of and also having the team and dedicated resources to repossess vehicles at the onset of delinquency is an additional cost of doing business. Repossessed vehicles are more of a “cost of doing business” and must be priced into deals, whereas repossessed vehicles might be considered more of a one-off situation for a franchised dealer.

Personal Goodwill – Just as a quick refresher, personal goodwill arises from the specific skills and experience of the owner/individual that attaches to the individual versus those traits/factors that attach to the dealership itself. Personal goodwill becomes important in divorce proceedings in states that distinguish between personal and enterprise goodwill and go the next step forward by defining personal goodwill as a NON-MARITAL Personal goodwill also matters in the purchase price allocation of a transaction, where value attributed to personal goodwill gets favorable taxation versus value allocated to other items, such as tangible assets or enterprise goodwill.

As readers are aware, we try to avoid absolutes (like “always” or “never”) when discussing controversial items in a litigation context. However, we generally think personal goodwill could have more of a presence with independent dealers than franchised dealers, although not necessarily guaranteed. Note: we are not saying that franchised dealers NEVER have personal goodwill, nor are we stating that independent dealers ALWAYS have personal goodwill.

Why can personal goodwill be more prevalent in independent dealers? Recall where earlier we described three types and strategies of independent dealers: high-end/classic, middle market, and BHPH. Those independent dealers might have to possess specific knowledge of what vehicles to purchase to appeal to their targeted demographic and what price to purchase those vehicles for in order to maximize profitability and minimize time on the lot before sale. In other words, independent dealers seek to acquire vehicles that will turn over/sell quickly and not sit on their lots or floor plans for an extended period of time. Finally, independent dealers must have knowledge of where to source their desired vehicles, such as auto auctions, third-party sales, social media, etc.

Conclusions

As we have highlighted, independent dealers have some similarities to franchised dealers but have specific nuances and factors that cause a greater impact to their success and profitability. If you have an independent dealership or are evaluating an investment in an independent dealership, contact a professional within the Auto Team at Mercer Capital.

At Mercer Capital, we follow the auto industry and adjacent industries closely to stay current with trends in the marketplace. These give insight into the market that may exist for a private dealership, which informs our valuation and litigation support engagements.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights