Comment on UWM Underwriters Subsidized by Appraisers by Kazys Skirpa

Appraisers Blog

APRIL 17, 2024

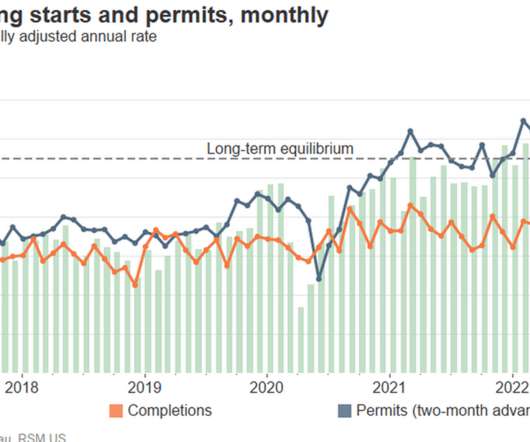

The appraisal, real estate and mortgage business is going to be horrible for some time. 89% of borrowers have an interest rate below 6%, 78% of borrowers have a rate below 5% while 59.5% have a rate below 4%. of borrowers have a rate below 3%. Now rates are above 7% and are going to stay there for a while.

Let's personalize your content