How Common is Insider Trading? Evidence from the Options Market

Reynolds Holding

SEPTEMBER 15, 2022

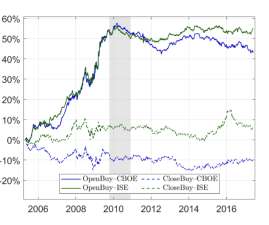

We address this challenge in a new paper on how option investors responded to a significant increase in the likelihood and severity of prosecution after hedge-fund manager Raj Rajaratnam’s arrest in October 2009. We focus on option investors because many prior studies show that option trades strongly predict future stock returns.

Let's personalize your content