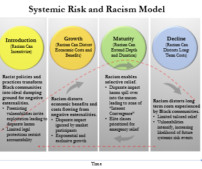

Racism and Systemic Risk

Harvard Corporate Governance

MAY 11, 2023

Posted by Cary Martin Shelby (Washington and Lee University), on Thursday, May 11, 2023 Editor's Note: Cary Martin Shelby is a Professor of Law at Washington and Lee University School of Law. This post is based on her recent paper , forthcoming in the Northwestern University Law Review. News of colossal bank failures have threatened economic stability once again.

Let's personalize your content