Creditors, Shareholders, and Losers In Between: A Failed Regulatory Experiment

Harvard Corporate Governance

MARCH 5, 2024

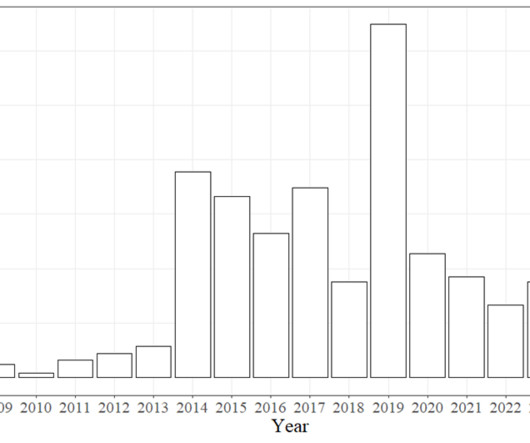

Posted by Albert H. Choi and Jeffery Y. Zhang, University of Michigan, on Tuesday, March 5, 2024 Editor's Note: Albert H. Choi is the Paul G. Kauper Professor of Law, and Jeffery Y. Zhang is an Assistant Professor of Law at the University of Michigan Law School. This post is based on their paper. In March 2023, a financial panic that began with runs on Silicon Valley Bank in California led to three of the four largest bank failures in US history.

Let's personalize your content