Evolving Notions of Board Effectiveness

Harvard Corporate Governance

DECEMBER 19, 2023

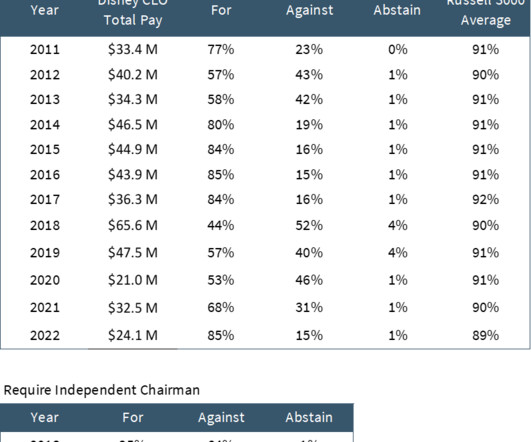

Posted by Richard Alsop, Shearman & Sterling LLP, on Tuesday, December 19, 2023 Editor's Note: Richard Alsop is a Partner at Shearman & Sterling LLP. This post is based on his Shearman memorandum. BOARD EFFECTIVENESS – TRADITIONAL APPROACHES Maximizing board effectiveness has been an ongoing and somewhat elusive corporate governance objective for U.S. corporate boards, executives and stockholders.

Let's personalize your content