8 Firms Lead $3.7B Sale Of Cigna Medicare Businesses

Law 360 M&A

JANUARY 31, 2024

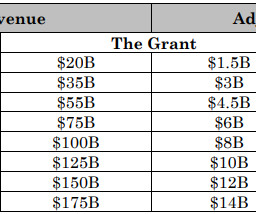

The Cigna Group will sell multiple health benefits and Medicare units to Health Care Service Corp., the companies said Wednesday in an announcement detailing a deal valued at around $3.7 billion and steered by Wachtell Lipton Rosen & Katz, Rule Garza Howley LLP, Mintz Levin Cohn Ferris Glovsky and Popeo PC and Sidley Austin LLP.

Let's personalize your content