How to Calculate Material Margin and Drive Competitive Pricing

Redpath

JUNE 22, 2023

Learn the formula for calculating material margin and how using it can help you set pricing that keeps you competitive in the manufacturing marketplace.

Redpath

JUNE 22, 2023

Learn the formula for calculating material margin and how using it can help you set pricing that keeps you competitive in the manufacturing marketplace.

Harvard Corporate Governance

JUNE 22, 2023

Posted by Eliezer M. Fich (Drexel University), Robert Parrino (University of Texas at Austin), and Anh L. Tran (City University of London) , on Thursday, June 22, 2023 Editor's Note: Eliezer M. Fich is Professor of Finance at Drexel University LeBow College of Business, Robert Parrino is Professor of Finance at the University of Texas at Austin, and Anh L.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

JUNE 22, 2023

Sales is a business about people and getting the right talent is vital—companies must reconsider their talent strategies and the sales roles they need to continue to drive growth.

Benzinga

JUNE 23, 2023

Tilray (NASDAQ: TLRY ) is making bold moves to secure a profitable future, and its latest acquisition of HEXO Corp. (NASDAQ: HEXO ) has solidified its position as Canada's top cannabis company with a 44% market share boost, expanding its market share by 467 basis points. Despite a challenging market, the strategic combination of Tilray and HEXO is expected to drive revenue growth and create significant opportunities for increased margins and earnings, with projected annualized cost savings o

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Brian DeChesare

JUNE 21, 2023

Investment banking in Dubai stands out for attracting remarkable hype on social media. You’ll find influencers on Instagram, TikTok, LinkedIn, and other sites constantly praising Dubai and claiming it’s the best place to work or start a business. It’s almost like the city has its own PR department and never-ending marketing campaign. If you’re interested in the Middle East or have connections to the region, all this hype has probably made you wonder about finance careers there.

Harvard Corporate Governance

JUNE 19, 2023

Posted by Donald J. Kochan (George Mason University), on Monday, June 19, 2023 Editor's Note: Donald J. Kochan is a Professor of Law and the Executive Director of the Law & Economics Center at George Mason University’s Antonin Scalia Law School. This post is based on his recent piece. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Lighter Capital

JUNE 20, 2023

In March 2020, Lighter Capital's entire team transitioned from a decade of working in a traditional office in Seattle to embracing the remote-only model. Today, the team is spread across four continents and nine countries and our clients span across the U.S. and Australia. In this ever-evolving landscape of remote and hybrid work, Lighter Capital has actively sought innovative ways to foster team building, inspire creativity, and solidify its goals and strategies.

Rhythm Systems

JUNE 19, 2023

Artificial Intelligence (AI) has been a buzzword for decades, but it's only in recent years that it's become a reality. Artificial Intelligence is already transforming how we live and work, and it will only become more prevalent in the future. But what does this mean for CEOs? How will AI impact their businesses in the next few years?

Harvard Corporate Governance

JUNE 19, 2023

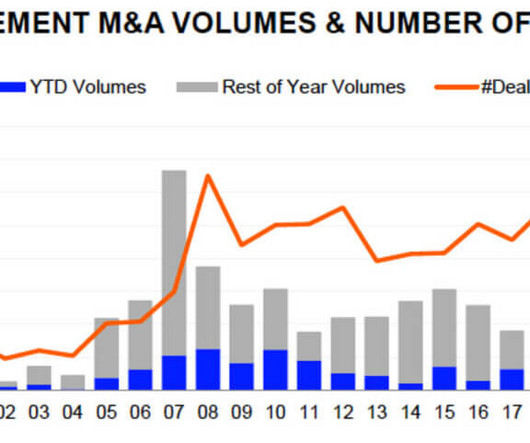

Posted by Shaun Mathew and Daniel Wolf, Kirkland & Ellis LLP, on Monday, June 19, 2023 Editor's Note: Shaun J. Mathew and Daniel E. Wolf are Partners at Kirkland & Ellis LLP. This post is based on a Kirkland & Ellis memorandum by Mr. Mathew, Mr. Wolf, Sarkis Jebejian , Eric L. Schiele , Erin Nealy Cox , Bob M. Hayward and several other Kirkland partners.

Mckinsey and Company

JUNE 20, 2023

New research on human development from the McKinsey Global Institute reveals a rich picture of Morocco’s development over the first two decades of the millennium, but pockets of concern remain.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Benzinga

JUNE 22, 2023

Retail investor-friendly brokerage Robinhood Markets Inc (NASDAQ: HOOD ) is pushing the boundaries of the fintech space with its strategic acquisition of San Francisco-based X1 , a platform that offers a no-fee credit card. What Happened: The move marks a step in Robinhood's journey to broaden its product offerings and deepen its relationship with existing customers.

Rhythm Systems

JUNE 20, 2023

A goal properly set is halfway reached, as famously said by Zig Ziglar. Setting goals is indeed crucial for achieving success and avoiding the constant state of reacting to urgent matters. Without a clear plan, valuable time can be wasted on non-priorities, leaving one exhausted and unaccomplished at the end of the day.

Harvard Corporate Governance

JUNE 21, 2023

Posted by Lawrence A. Cunningham, Arvin Maskin and James B. Carlson, Mayer Brown LLP, on Wednesday, June 21, 2023 Editor's Note: Lawrence A. Cunningham is Special Counsel, Arvin Maskin is a Partner, and James B. Carlson is Senior Counsel at Mayer Brown LLP. This post is based on a Mayer Brown memorandum by Mr. Cunningham, Mr. Maskin, Mr. Carlson, Joseph Castelluccio , Andrew J.

Mckinsey and Company

JUNE 23, 2023

More access to funding for underrepresented start-up founders can unlock massive investment and innovation opportunities. These founders are not just underrepresented—they are underestimated.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Avanade

JUNE 21, 2023

Chris Willis explains that transformation is not an end state but rather a continual process that is dynamic in design and nature, characterized by constant change.

NYT M&A

JUNE 23, 2023

With the rapid rise of women’s soccer, Y. Michele Kang, the owner of the Washington Spirit, is in the vanguard of transforming ownership and management worldwide.

Harvard Corporate Governance

JUNE 18, 2023

Posted by Samuel P. Groner, Katherine L. St. Romain, Michael P. Sternheim, Fried, Frank, Harris, Shriver & Jacobson LLP, on Sunday, June 18, 2023 Editor's Note: Samuel P. Groner and Michael P. Sternheim are Partners and Katherine L. St. Romain is an Associate at Fried, Frank, Harris, Shriver & Jacobson LLP. This post is based on a Fried Frank memorandum by Mr.

Mckinsey and Company

JUNE 22, 2023

Consumers slightly more optimistic as inflation stabilizes; developed economies struggle to maintain GDP momentum in face of headwinds; labor markets tight; China rebound slows; India economy positive.

Avanade

JUNE 19, 2023

Nikky van Dyk outlines three common challenges on the enterprise AI journey – from trials to implementation and operating or maintaining AI – and how to navigate them securely while still realising benefits.

NYT M&A

JUNE 21, 2023

Two new books offer harsh assessments of private equity firms that specializes in buying up companies only to saddle them with debt and squeeze them for profits.

Harvard Corporate Governance

JUNE 23, 2023

Posted by the Harvard Law School Forum on Corporate Governance, on Friday, June 23, 2023 Editor's Note: This roundup contains a collection of the posts published on the Forum during the week of June 16-22, 2023. Key Components and Trends of CVRs in Life Sciences Public M&A Deals Posted by Sally Wagner Partin, Sharon Flanagan, and Hannah M. Brown, Sidley Austin LLP, on Friday, June 16, 2023 Tags: Contingent value right , corporate deals , external evaluations , Liability standards , Merger li

Mckinsey and Company

JUNE 23, 2023

Bioengineering is the application of engineering principles to improve disease prevention and treatment, agricultural production, energy sustainability, and more.

N Contracts

JUNE 20, 2023

As environmental, social, and governance (ESG) issues continue to gain prominence, some financial institutions are looking for ways to integrate ESG considerations into their vendor risk management processes. These financial institutions want to ensure third-party partners have internal guidelines, ethics, and controls that align with the institution’s ESG policies.

NYT M&A

JUNE 20, 2023

The Chinese tech giant says its top leader, Daniel Zhang, will make way for two long-serving executives: Joseph Tsai takes over as chairman and Eddie Yongming Wu becomes chief executive.

Harvard Corporate Governance

JUNE 23, 2023

Posted by Subodh Mishra, Institutional Shareholder Services, Inc., on Friday, June 23, 2023 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. This post is based on a recent editorial by Gary Retelny , President and CEO of Institutional Shareholder Services, Inc. My firm, Institutional Shareholder Services (ISS), has over recent months been subject to a growing chorus of partisan attacks meant to malign our work and brand us as “woke activis

Mckinsey and Company

JUNE 20, 2023

New research from the McKinsey Global Institute provides a more nuanced, long-term view of Nigeria’s development progress from 2000 to 2019 that may help the country shape its future direction.

Financial Times M&A

JUNE 18, 2023

Securities division has been for sale since Silicon Valley Bank’s failure in March sent tremors through banking industry

BV Specialists

JUNE 19, 2023

We receive several valuation inquiries every year from companies still in their infancy stages that are looking to attract new investment through private equity or by bringing in additional partners with the right talent to help them achieve their goals. These “start-ups” are often thought to come from the various technology markets, however, anytime an entrepreneur begins the process of developing a business from scratch, regardless of the industry, they are considered a start-up.

Harvard Corporate Governance

JUNE 20, 2023

Posted by Zachery M. Halem (Lazard Freres & Co.) , on Tuesday, June 20, 2023 Editor's Note: Zachery M. Halem is the Director of the Climate Center at Lazard Freres & Co. This post is based on a recent paper by Mr. Halem, Joseph E. Aldy , Professor of the Practice of Public Policy at the John F. Kennedy School of Government at Harvard University; Patrick Bolton , the Barbara and David Zalaznick Professor Emeritus of Business at Columbia Business School, Marcin T.

Mckinsey and Company

JUNE 20, 2023

Energy companies have faced considerable uncertainty. Those that can identify opportunities and act quickly can profitably grow their business in the years to come and increase their lead over peers.

Machen McChesney

JUNE 23, 2023

If your profitable business has trouble making ends meet, it’s not alone. Many business owners mistakenly equate profits with cash flow, leading to shortfalls in the checking account. The truth is that there are many reasons these numbers might differ.

Financial Times M&A

JUNE 17, 2023

News, analysis and comment from the Financial Times, the worldʼs leading global business publication

Harvard Corporate Governance

JUNE 20, 2023

Posted by Susan H. Mac Cormac (Morrison Foerster LLP), Michael P. Santos (Morrison Foerster LLP), and Divya Walia, (Impact Capital Managers), on Tuesday, June 20, 2023 Editor's Note: Susan H. Mac Cormac is a Partner and Michael P. Santos is an Associate at Morrison Foerster LLP, and Divya Walia is a Research Fellow at Impact Capital Managers. This post is based on a Morrison Foerster and Impact Capital Managers memorandum by Ms.

Mckinsey and Company

JUNE 20, 2023

Sharpen your problem-solving skills the McKinsey way, with our weekly crossword. Each puzzle is created with the McKinsey audience in mind, and includes a subtle (and sometimes not-so-subtle) business theme for you to find. Answers that are directionally correct may not cut it if you’re looking for a quick win.

Let's personalize your content