2023 Silicon Valley 150: Corporate Governance Report

Harvard Corporate Governance

JANUARY 29, 2024

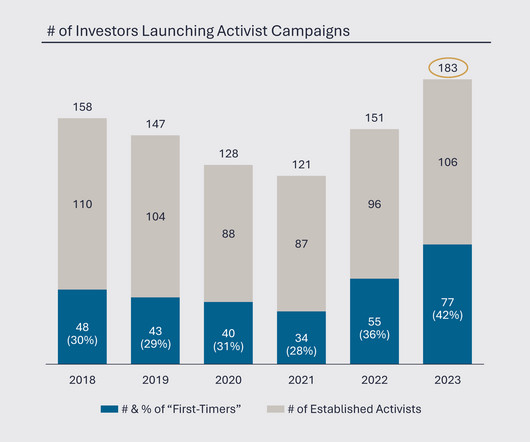

Posted by Richard Blake, Wilson Sonsini Goodrich & Rosati, on Monday, January 29, 2024 Editor's Note: Richard Blake is a Partner at Wilson Sonsini Goodrich & Rosati. This post is based on a WSGR memorandum by Mr. Blake, Lillian Jenks , Courtney Mathes , and Barbara Novak. Our 2023 Silicon Valley 150 Corporate Governance Report reviews the corporate governance practices and disclosures of the Valley’s largest public companies.

Let's personalize your content