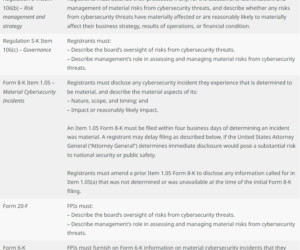

SEC Adopts Final Rules on Cybersecurity Disclosure

Harvard Corporate Governance

AUGUST 9, 2023

Posted by Cydney S. Posner, Cooley LLP, on Wednesday, August 9, 2023 Editor's Note: Cydney S. Posner is Special Counsel at Cooley LLP. This post is based on her Cooley memorandum. At an open meeting on Wednesday last week, the SEC voted, three to two, to adopt final rules on cybersecurity disclosure. In his statement at the open meeting, Commissioner Jaime Lizárraga shared the stunning statistics that, last year, 83% of companies experienced more than one data breach, with an average cost of

Let's personalize your content