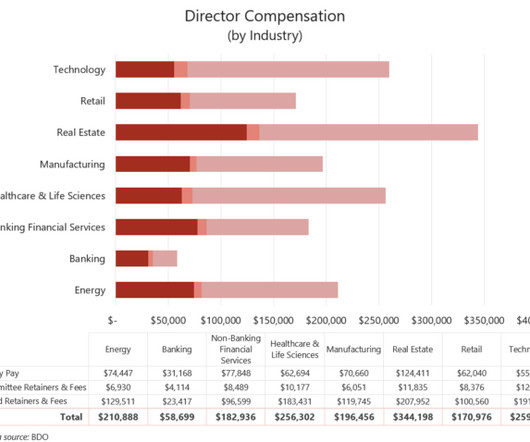

Trends in Director Compensation

Harvard Corporate Governance

JANUARY 26, 2024

Posted by Lawrence A. Cunningham and Carlos Juarez, Mayer Brown LLP, on Friday, January 26, 2024 Editor's Note: Lawrence A. Cunningham is Special Counsel in Mayer Brown’s New York office, and Carlos Juarez is a Project Administrator at Mayer Brown LLP and J.D. Candidate at Villanova University Charles Widger School of Law. This post is based on their Mayer Brown memorandum.

Let's personalize your content