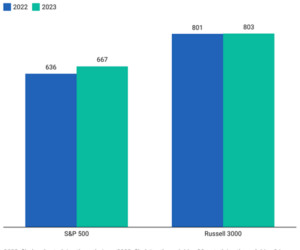

Anti-ESG Shareholder Proposals in 2023

Harvard Corporate Governance

JUNE 1, 2023

Posted by Heidi Welsh, Sustainable Investment Institute, on Thursday, June 1, 2023 Editor's Note: Heidi Welsh is the Executive Director at the Sustainable Investments Institute. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A. Bebchuk and Roberto Tallarita ; How Much Do Investors Care about Social Responsibility?

Let's personalize your content