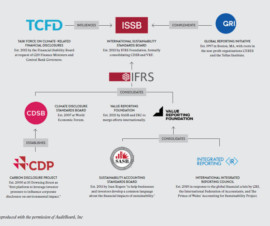

The Rise of International ESG Disclosure Standards

Harvard Corporate Governance

JUNE 29, 2023

Posted by David A. Cifrino, McDermott Will & Emery LLP, on Thursday, June 29, 2023 Editor's Note: David A. Cifrino is Counsel at McDermott Will & Emery LLP. This post is based on his MWE memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A.

Let's personalize your content