Strategic Compliance

Harvard Corporate Governance

JANUARY 16, 2024

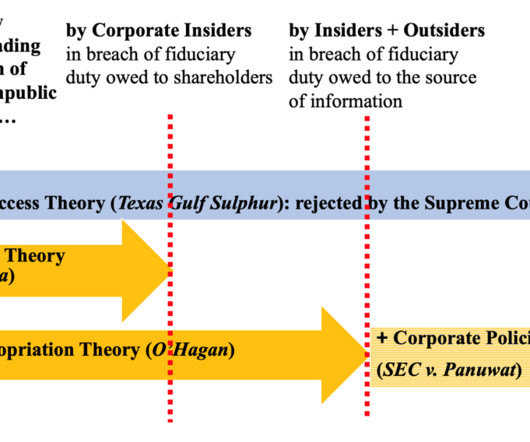

Posted by Geeyoung Min (Michigan State University), on Tuesday, January 16, 2024 Editor's Note: Geeyoung Min is an Assistant Professor of Law at Michigan State University. This post is based on her recent article published in the UC Davis Law Review. Corporate compliance is at an inflection point, putting pressure on companies to reinforce their compliance programs more than ever before.

Let's personalize your content