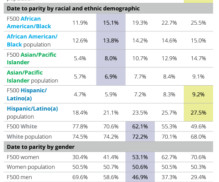

Board Diversity Census on Fortune 500 Boards

Harvard Corporate Governance

JULY 28, 2023

Posted by Carey Oven, Caroline Schoenecker, (Deloitte & Touche LLP) and Cid Wilson (Hispanic Association on Corporate Responsibility) , on Friday, July 28, 2023 Editor's Note: Carey Oven is National Managing Partner at the Center for Board Effectiveness and Chief Talent Officer, Caroline Schoenecker is an Experience Director at Deloitte & Touche LLP and Cid Wilson is the President and CEO of the Hispanic Association on Corporate Responsibility.

Let's personalize your content