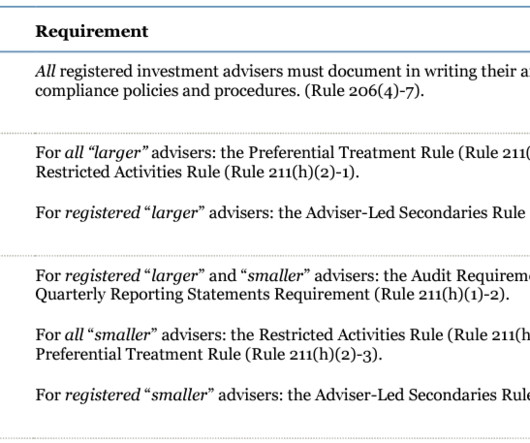

Regulatory Spotlight on Private Funds

Harvard Corporate Governance

NOVEMBER 19, 2023

Posted by Meaghan Kelly, David Blass and Michael Osnato, Simpson Thacher & Bartlett LLP, on Sunday, November 19, 2023 Editor's Note: Meaghan Kelly , David Blass , and Michael Osnato are Partners at Simpson Thacher & Bartlett LLP. This post is based on a Simpson Thacher memorandum by Ms. Kelly, Mr. Blass, Mr. Osnato, Nicholas Goldin , Michael Wolitzer , and Marc Berger.

Let's personalize your content