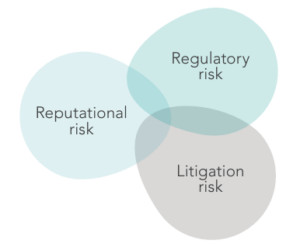

Greenwashing: Navigating the Risk

Harvard Corporate Governance

JULY 24, 2023

Posted by Peter Pears, Tim Baines, and Oliver Williams, Mayer Brown LLP, on Monday, July 24, 2023 Editor's Note: Peter Pears and Tim Baines are Partners and Oliver Williams is a Trainee Solicitor at Mayer Brown LLP. This post is based on a Mayer Brown memorandum by Mr. Pears, Mr. Baines, Mr. Williams, Henninger S. Bullock , Luiz Gustavo Bezerra , and Wei Na Sim.

Let's personalize your content