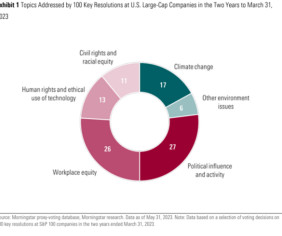

Proxy-Voting Insights: How Differently Do The Big Three Vote on ESG Resolutions

Harvard Corporate Governance

JULY 3, 2023

Posted by Lindsey Stewart, Morningstar, Inc., on Monday, July 3, 2023 Editor's Note: Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here ) by Lucian Bebchuk, Alma Cohen, and Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy (d

Let's personalize your content