Do Investors Care About Impact?

Harvard Corporate Governance

JUNE 8, 2023

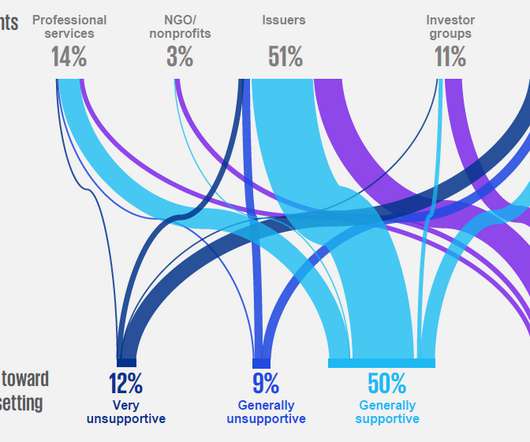

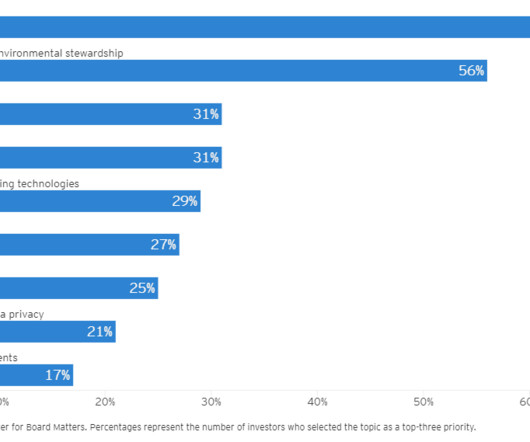

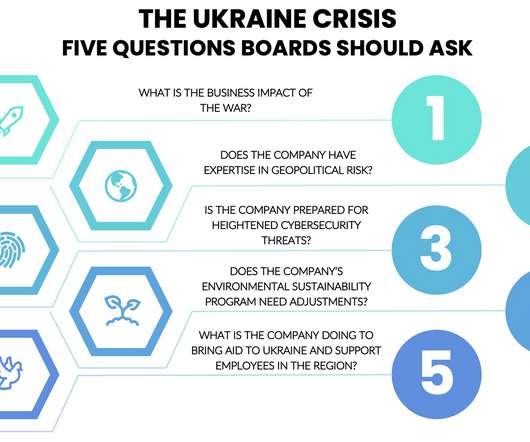

Bebchuk and Roberto Tallarita ; How Much Do Investors Care about Social Responsibility? Do investors care about impact? Yes, in the same way, they care about pandas. We provide this answer in our paper «Do Investors Care About Impact?”, People care a lot about pandas, no doubt. more…)

Let's personalize your content