Country Risk: A 2022 Mid-year Update!

Musings on Markets

JULY 13, 2022

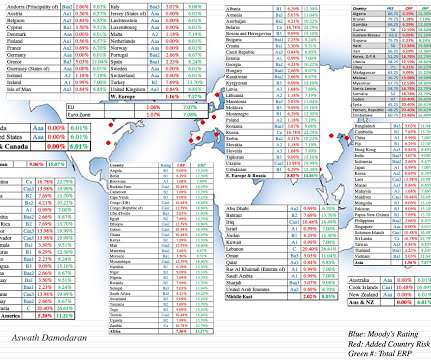

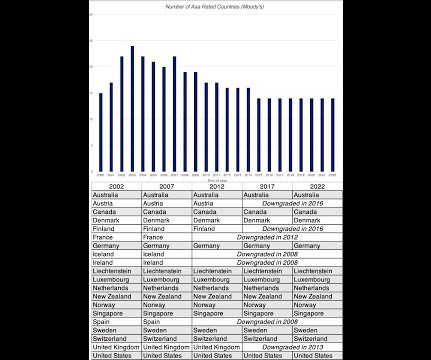

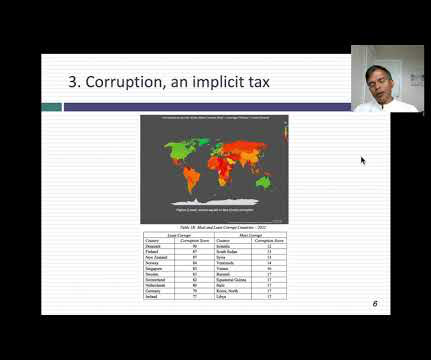

Country Risk: Default Risk and Ratings For investors, the most direct measures of country risk come from measures of their capacity to default on their borrowings. Third, corruption operates as an implicit tax , since business operating in corrupt parts of the world have to build in the associated costs and constraints.

Let's personalize your content