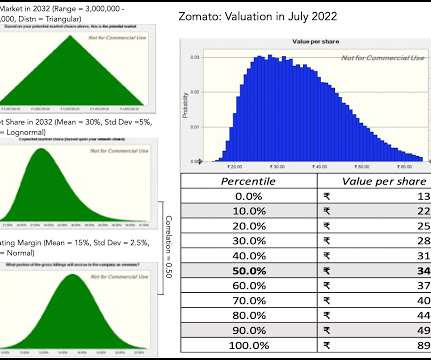

A Zomato 2022 Update: Value, Pricing and the Gap

Musings on Markets

JULY 27, 2022

At close of trading on July 26, 2022, the stock was trading at ? In this post, I will begin with a quick review of my 2021 valuation, then move on to the price action in 2021 and 2022 and then update my valuation to reflect the company's current numbers. 46 in July 2022. 68746 (including short term investments) in March 2022.

Let's personalize your content